Why Buy Aon Stock? Market Analysis

The decision to invest in Aon stock, like any other investment, should be based on a thorough analysis of the company's financial health, market position, and future prospects. Aon plc, a British-American multinational corporation, is a leading global professional services firm that provides a range of risk, retirement, and health solutions. To understand why one might consider buying Aon stock, it's essential to delve into the company's strengths, its position within the industry, and the broader market trends that could influence its stock performance.

Market Position and Strengths

Aon has established itself as a major player in the insurance brokerage and consulting services sector. Its diverse portfolio of services, including risk management, insurance brokerage, retirement consulting, and health consulting, positions the company to capitalize on a wide range of client needs. Aon’s global reach, with operations in over 120 countries, allows it to serve a broad client base and tap into emerging markets. Moreover, the company’s reputation for expertise in managing complex risks and its ability to provide innovative solutions are significant competitive advantages. The insurance brokerage market, in particular, is characterized by high barriers to entry due to regulatory requirements and the need for extensive industry knowledge, which protects Aon’s market position.

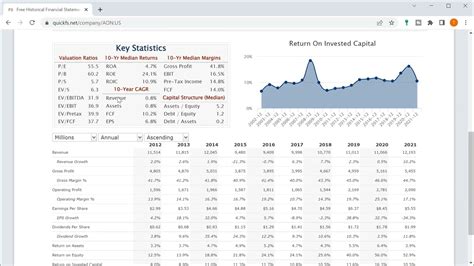

Financial Performance and Growth Prospects

Aon’s financial performance has been stable and growing, with the company consistently reporting increases in revenue and operating income. This stability is partly due to the recurring nature of much of its business, as well as its efforts to expand its services into higher-margin areas. The company’s diversification strategy, including investments in digital platforms and data analytics, is aimed at driving future growth and enhancing its service offerings. For investors, Aon’s commitment to returning value through share repurchases and dividends can make the stock more attractive, especially for those seeking regular income from their investments.

| Financial Metric | 2022 Value | 2021 Value |

|---|---|---|

| Revenue (in billions USD) | 12.1 | 11.4 |

| Operating Income (in billions USD) | 2.5 | 2.2 |

| Net Income (in billions USD) | 1.3 | 1.1 |

Market Trends and Industry Outlook

The insurance brokerage and consulting services industry is influenced by various market trends, including the increasing demand for risk management solutions due to global uncertainty and regulatory complexity. The trend towards digitalization in the insurance sector also presents opportunities for companies like Aon to leverage technology and data analytics to enhance their services and operational efficiency. Moreover, the consolidation trend in the industry could lead to further growth opportunities for Aon through strategic acquisitions. Understanding these trends and how Aon is positioned to capitalize on them is crucial for investors assessing the potential of the company’s stock.

Risk Considerations and Mitigation Strategies

While Aon’s strengths and market position are compelling, investors must also consider the potential risks. These include market competition, regulatory changes, and economic downturns that could impact client demand for insurance and consulting services. Aon’s strategy to mitigate these risks includes investing in innovation and digital transformation, maintaining a strong balance sheet to withstand economic fluctuations, and diversifying its service offerings to reduce dependence on any single market or client segment.

- Regulatory Compliance: Adhering to evolving regulatory requirements across different markets.

- Talent Acquisition and Retention: Attracting and retaining skilled professionals in a competitive labor market.

- Technological Advancements: Continuously investing in technology to stay ahead of industry trends and improve operational efficiency.

What are the key factors driving the growth of Aon's stock?

+The growth of Aon's stock is driven by several key factors, including its stable financial performance, strategic expansion into high-margin services, commitment to returning value to shareholders, and its strong position in a market with high barriers to entry. Additionally, the company's ability to adapt to and capitalize on industry trends such as digitalization and consolidation is expected to support long-term growth.

How does Aon mitigate the risks associated with market fluctuations and competition?

+Aon mitigates these risks through a combination of strategies, including diversifying its service portfolio, investing in innovation and digital transformation, maintaining a strong financial position, and pursuing strategic acquisitions to enhance its market presence and capabilities. By focusing on organic growth and operational efficiency, Aon aims to reduce its vulnerability to external market factors.

In conclusion, the decision to buy Aon stock should be informed by a comprehensive analysis of the company’s strengths, market position, financial performance, and growth prospects, as well as an understanding of the broader industry trends and potential risks. By considering these factors, investors can make an informed decision about whether Aon stock aligns with their investment objectives and risk tolerance.