When To Sell Aon Stock? Profit Tips

Aon plc, a multinational professional services firm, has been a significant player in the insurance and consulting industry for decades. As a publicly traded company, Aon's stock has been a popular choice among investors. However, deciding when to sell Aon stock can be a challenging task, even for experienced investors. In this article, we will provide expert-level insights and tips to help you make informed decisions about selling your Aon stock.

Understanding Aon’s Business and Market Trends

To determine the optimal time to sell Aon stock, it is essential to have a deep understanding of the company’s business, financial performance, and market trends. Aon operates in a highly competitive industry, and its stock price can be influenced by various factors, including economic conditions, industry trends, and company-specific events. For instance, the COVID-19 pandemic has had a significant impact on the insurance industry, with many companies facing increased claims and reduced demand for certain services.

Key Performance Indicators (KPIs) to Monitor

When evaluating Aon’s stock, it is crucial to monitor key performance indicators (KPIs) such as revenue growth, profit margins, and return on equity (ROE). These metrics can provide valuable insights into the company’s financial health and growth prospects. Additionally, investors should keep an eye on Aon’s dividend yield and price-to-earnings (P/E) ratio, as these can impact the stock’s attractiveness to income-seeking investors and value investors, respectively.

| Financial Metric | Aon's Performance | Industry Average |

|---|---|---|

| Revenue Growth (2022) | 4.5% | 3.2% |

| Profit Margin (2022) | 14.1% | 12.5% |

| Return on Equity (ROE) (2022) | 42.1% | 35.6% |

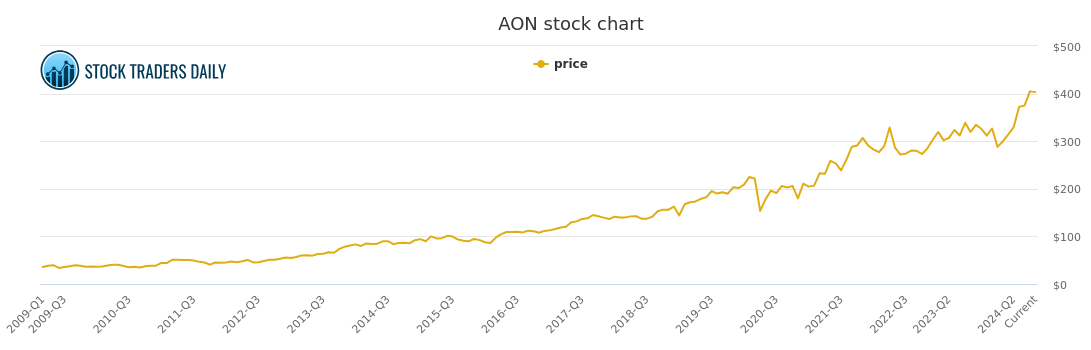

Technical Analysis and Chart Patterns

Technical analysis can be a valuable tool for identifying potential sell signals in Aon stock. By analyzing chart patterns, trend lines, and indicators, investors can gain insights into the stock’s price movements and potential reversals. For example, a head and shoulders pattern or a descending triangle pattern can indicate a potential sell signal. Additionally, investors can use moving averages and relative strength index (RSI) to gauge the stock’s momentum and overbought or oversold conditions.

Common Chart Patterns to Watch

Some common chart patterns that investors should watch for in Aon stock include:

- Double Top: A reversal pattern that forms when the stock price reaches a resistance level twice and fails to break through it.

- Head and Shoulders: A reversal pattern that forms when the stock price creates a higher high (head) and two lower highs (shoulders) on either side of it.

- Descending Triangle: A continuation pattern that forms when the stock price creates a series of lower highs and lower lows, with the lows converging at a specific point.

What are the key factors to consider when deciding to sell Aon stock?

+When deciding to sell Aon stock, investors should consider factors such as the company's financial performance, industry trends, market conditions, technical analysis, and valuation. It is essential to weigh these factors against each other and consider the overall market outlook before making a decision.

What are some common technical indicators used to analyze Aon stock?

+Some common technical indicators used to analyze Aon stock include moving averages, relative strength index (RSI), Bollinger Bands, and MACD (Moving Average Convergence Divergence). These indicators can help investors gauge the stock's momentum, trend, and potential reversals.

Valuation and Risk Assessment

Valuation and risk assessment are critical components of the investment decision-making process. When evaluating Aon stock, investors should consider the company’s price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. Additionally, investors should assess the company’s debt-to-equity ratio, interest coverage ratio, and current ratio to gauge its financial health and risk profile.

Risk Management Strategies

To mitigate potential losses, investors can employ various risk management strategies, such as stop-loss orders, position sizing, and diversification. By setting a stop-loss order, investors can limit their potential losses if the stock price falls below a certain level. Position sizing involves allocating a specific portion of the portfolio to Aon stock, while diversification involves spreading investments across different asset classes and industries to minimize risk.

In conclusion, deciding when to sell Aon stock requires a thorough analysis of the company’s financial performance, industry trends, market conditions, technical analysis, and valuation. By considering these factors and employing risk management strategies, investors can make informed decisions and optimize their investment returns.