When To Buy Aon Insurance? Timing Tips

Buying insurance is a crucial decision that requires careful consideration of various factors, including your financial situation, risk tolerance, and personal circumstances. Aon insurance, in particular, offers a wide range of products and services designed to help individuals and businesses manage risk and protect their assets. When it comes to deciding when to buy Aon insurance, timing is everything. In this article, we will provide you with timing tips to help you make an informed decision.

Understanding Aon Insurance Products

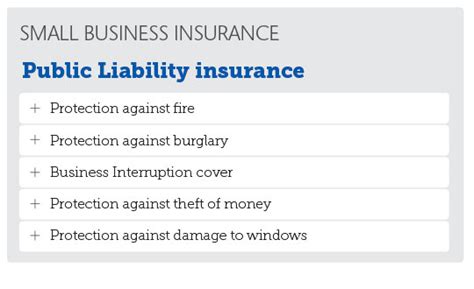

Aon insurance offers a diverse portfolio of products, including life insurance, health insurance, property insurance, and liability insurance, among others. Each product is designed to address specific risks and needs, and the right timing is essential to maximize the benefits. For instance, buying life insurance at a young age can help you lock in lower premiums and build a safety net for your loved ones. On the other hand, purchasing health insurance during open enrollment periods can ensure that you have continuous coverage and avoid penalties.

Key Considerations for Buying Aon Insurance

Before buying Aon insurance, it’s essential to consider several key factors, including your budget, risk profile, and personal goals. Budget is a critical consideration, as you need to ensure that you can afford the premiums without straining your finances. Your risk profile is also important, as it will help you determine the type and amount of coverage you need. Finally, your personal goals should align with the insurance product you choose, whether it’s to protect your family, business, or assets.

| Insurance Product | Key Considerations |

|---|---|

| Life Insurance | Budget, age, health, and dependents |

| Health Insurance | Age, health, income, and pre-existing conditions |

| Property Insurance | Property value, location, and risk profile |

Timing Tips for Buying Aon Insurance

Now that we’ve discussed the key considerations for buying Aon insurance, let’s dive into some timing tips to help you make the most of your investment. Buy early to lock in lower premiums and build a safety net for your loved ones. Open enrollment periods are also critical, as they provide an opportunity to purchase or update your insurance coverage without penalties. Additionally, major life events, such as marriage, divorce, or the birth of a child, can trigger the need for new or updated insurance coverage.

Seasonal and Periodic Timing Considerations

Certain times of the year or specific periods can be ideal for buying Aon insurance. For instance, summer months may be a good time to review and update your property insurance coverage, while open enrollment periods in the fall may be ideal for purchasing or updating your health insurance coverage. It’s also essential to consider economic cycles and regulatory changes that may impact insurance premiums and availability.

- Summer months: Review and update property insurance coverage

- Open enrollment periods: Purchase or update health insurance coverage

- Economic cycles: Consider the impact on insurance premiums and availability

What is the best time to buy Aon insurance?

+The best time to buy Aon insurance depends on your individual circumstances and needs. However, buying early, during open enrollment periods, or after major life events can be ideal.

How often should I review my Aon insurance coverage?

+You should review and update your Aon insurance coverage regularly, ideally every 6-12 months, or after major life events, to ensure that it remains aligned with your changing needs and circumstances.

In conclusion, buying Aon insurance requires careful consideration of various factors, including your budget, risk profile, and personal goals. By understanding the key considerations and timing tips outlined in this article, you can make an informed decision and maximize the benefits of your insurance investment. Remember to review and update your coverage regularly to ensure that it remains aligned with your changing needs and circumstances.