When Cyber Insurance Is Necessary? Don't Delay

Cyber insurance is a type of insurance policy that helps protect businesses and individuals from the financial consequences of cyber attacks and data breaches. In today's digital age, where technology is increasingly integrated into every aspect of our lives, the risk of cyber threats is higher than ever. Cyber insurance is necessary for any organization or individual that relies on technology to operate, as it provides a financial safety net in the event of a cyber attack or data breach. The question is no longer whether cyber insurance is necessary, but rather when it is necessary to invest in such a policy.

Understanding the Risks of Cyber Attacks

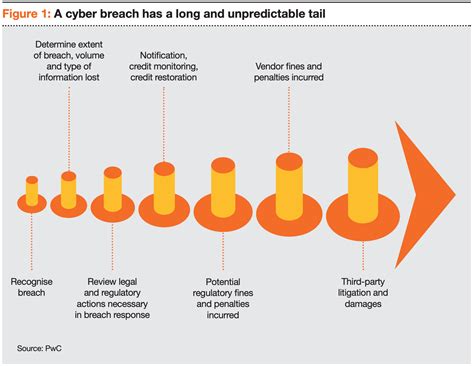

Cyber attacks can come in many forms, including malware, phishing, ransomware, and distributed denial-of-service (DDoS) attacks. These types of attacks can result in significant financial losses, damage to reputation, and legal liabilities. According to recent statistics, the average cost of a data breach is approximately 3.9 million, with the cost of a cyber attack ranging from 1.1 million to $16.3 million or more, depending on the severity of the attack and the industry affected. Cyber attacks are becoming more sophisticated and frequent, making it essential for organizations to invest in cyber insurance to mitigate these risks.

Industries That Require Cyber Insurance

Certain industries are more vulnerable to cyber attacks than others, and therefore, require cyber insurance. These industries include healthcare, finance, e-commerce, and government agencies. Organizations in these industries handle sensitive customer data, making them a prime target for cyber attacks. Investing in cyber insurance can help these organizations protect themselves from the financial consequences of a cyber attack or data breach. Additionally, organizations that store sensitive data, such as personally identifiable information (PII) or protected health information (PHI), are also at risk and should consider investing in cyber insurance.

| Industry | Risk Level | Cyber Insurance Needs |

|---|---|---|

| Healthcare | High | Comprehensive coverage for data breaches and cyber attacks |

| Finance | High | Coverage for cyber attacks, data breaches, and regulatory compliance |

| E-commerce | Medium | Coverage for data breaches, cyber attacks, and business interruption |

| Government Agencies | High | Coverage for cyber attacks, data breaches, and regulatory compliance |

When to Invest in Cyber Insurance

Any organization or individual that relies on technology to operate should consider investing in cyber insurance. The sooner, the better, as cyber attacks can happen at any time, and it’s essential to be prepared. Some specific scenarios where cyber insurance is necessary include:

- When an organization handles sensitive customer data, such as PII or PHI

- When an organization operates in a high-risk industry, such as healthcare or finance

- When an organization has a large online presence, such as an e-commerce website

- When an organization has experienced a cyber attack or data breach in the past

Don't delay in investing in cyber insurance, as the risks of cyber attacks are increasing every day. By investing in cyber insurance, organizations can reduce the financial impact of a cyber attack or data breach, and can also provide access to expert resources and services to help respond to and manage a cyber incident.

What is the average cost of a cyber attack?

+The average cost of a cyber attack can range from $1.1 million to $16.3 million or more, depending on the severity of the attack and the industry affected.

Which industries are most vulnerable to cyber attacks?

+Certain industries, such as healthcare, finance, e-commerce, and government agencies, are more vulnerable to cyber attacks due to the sensitive data they handle.

What are the benefits of investing in cyber insurance?

+Investing in cyber insurance can help organizations reduce the financial impact of a cyber attack or data breach, and can also provide access to expert resources and services to help respond to and manage a cyber incident.

In conclusion, cyber insurance is a necessary investment for any organization or individual that relies on technology to operate. By understanding the risks of cyber attacks and investing in cyber insurance, organizations can reduce the financial impact of a cyber attack or data breach, and can also provide access to expert resources and services to help respond to and manage a cyber incident. Don’t delay in investing in cyber insurance, as the risks of cyber attacks are increasing every day.