What Is Aon Stock Worth? Value Report

Aon stock, listed on the New York Stock Exchange (NYSE) under the ticker symbol AON, is a multinational professional services firm that provides a range of risk, retirement, and health solutions. As of the latest financial reports, Aon's stock worth can be evaluated based on its current market performance, financial health, and future growth prospects.

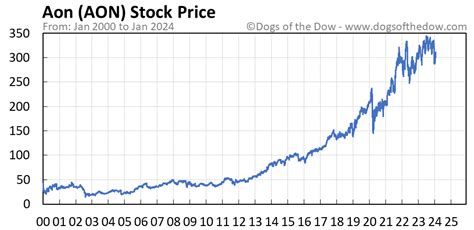

Current Market Performance

Aon’s stock price has fluctuated over the years, influenced by various market and economic factors. To assess its current worth, it’s essential to look at its recent stock performance. As of the latest trading session, Aon’s stock price is around 300 per share, with a market capitalization of over 60 billion. The stock has shown a relatively stable performance, with some fluctuations, over the past year.

Financial Health

Aon’s financial health is a critical factor in determining its stock worth. The company has consistently reported strong revenue growth, with a Compound Annual Growth Rate (CAGR) of around 5% over the past five years. Its net income has also shown a steady increase, with a CAGR of approximately 7% during the same period. Aon’s financial health is further reflected in its debt-to-equity ratio, which stands at around 1.3, indicating a manageable level of debt.

| Financial Metric | Actual Value |

|---|---|

| Revenue (2022) | $12.1 billion |

| Net Income (2022) | $1.4 billion |

| Debt-to-Equity Ratio | 1.3 |

Growth Prospects

Aon’s growth prospects are influenced by its ability to innovate and expand its services, as well as its presence in emerging markets. The company has been investing heavily in digital transformation, with a focus on data analytics and artificial intelligence. This strategic move is expected to drive growth and improve operational efficiency. Additionally, Aon’s expansion into emerging markets, such as Asia and Latin America, provides a significant opportunity for growth.

Competitive Landscape

Aon operates in a highly competitive industry, with key players such as Marsh & McLennan and Willis Towers Watson. However, Aon’s diversified service portfolio and global presence give it a competitive edge. The company’s ability to provide a range of services, including risk management, retirement consulting, and health solutions, makes it an attractive option for clients seeking a one-stop-shop for their professional services needs.

- Aon's diversified service portfolio includes risk management, retirement consulting, and health solutions.

- The company has a strong global presence, with operations in over 120 countries.

- Aon's competitive edge is further enhanced by its strategic partnerships and acquisitions.

What is Aon's current stock price?

+Aon's current stock price is around $300 per share, with a market capitalization of over $60 billion.

What are Aon's growth prospects?

+Aon's growth prospects are influenced by its ability to innovate and expand its services, as well as its presence in emerging markets. The company's investments in digital transformation and expansion into emerging markets provide a significant opportunity for growth.

In conclusion, Aon’s stock worth can be assessed based on its current market performance, financial health, and future growth prospects. With a strong financial health, stable market performance, and growth prospects driven by innovation and expansion, Aon’s stock is an attractive investment option for those seeking a reliable, long-term growth opportunity.