What Is 401K Pep Vesting? Ownership Explained

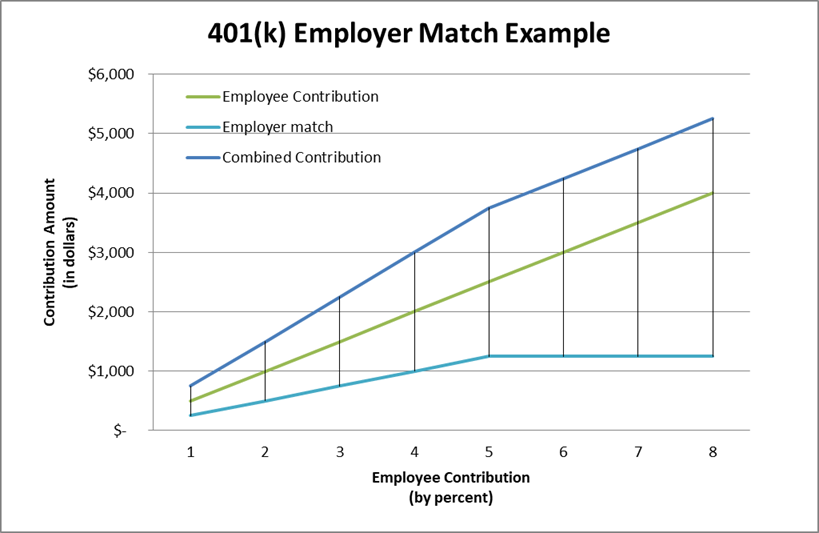

401K Pep vesting is a crucial aspect of retirement planning, particularly for individuals participating in employer-sponsored 401K plans. The concept of vesting refers to the process by which an employee gains full ownership of the employer contributions made to their 401K account. Understanding how 401K Pep vesting works is essential for maximizing retirement savings and making informed decisions about one's financial future. In this explanation, we will delve into the details of 401K Pep vesting, including how it works, the different types of vesting schedules, and the implications for employees.

What is 401K Pep Vesting?

401K Pep vesting is a feature of some 401K plans that allows employees to become fully vested in the employer contributions over a specified period. The term “Pep” refers to the Pension Equity Plan, which is a type of defined contribution plan that combines elements of traditional pension plans with the flexibility of 401K plans. In a 401K Pep plan, the employer contributions are typically subject to a vesting schedule, which determines when the employee becomes fully owner of the funds.

How Does 401K Pep Vesting Work?

The vesting schedule for 401K Pep plans can vary depending on the employer and the specific plan design. Typically, the vesting schedule is based on the employee’s years of service with the company. For example, a common vesting schedule might be:

| Years of Service | Vesting Percentage |

|---|---|

| 0-1 year | 0% |

| 1-2 years | 20% |

| 2-3 years | 40% |

| 3-4 years | 60% |

| 4-5 years | 80% |

| 5+ years | 100% |

In this example, an employee who has been with the company for 3 years would be 60% vested in the employer contributions. This means that if the employee were to leave the company, they would be able to take 60% of the employer contributions with them, while the remaining 40% would be forfeited.

Types of Vesting Schedules

There are several types of vesting schedules that employers can use for their 401K Pep plans. The most common types include:

- Cliff vesting: This type of vesting schedule provides that an employee becomes 100% vested in the employer contributions after a specified period, usually 3-5 years.

- Gradual vesting: This type of vesting schedule provides that an employee becomes vested in the employer contributions over a specified period, usually 3-6 years, with a increasing percentage of vesting each year.

- Immediate vesting: This type of vesting schedule provides that an employee is 100% vested in the employer contributions from the date of hire.

Implications for Employees

Understanding the vesting schedule for a 401K Pep plan is crucial for employees to make informed decisions about their retirement savings. Employees who are considering leaving their job should carefully review their plan documents to determine the vesting schedule and how it applies to their situation. Additionally, employees who are nearing retirement should ensure that they understand the vesting schedule and how it may impact their retirement benefits.

What happens to my 401K Pep account if I leave my job before I am fully vested?

+If you leave your job before you are fully vested, you will typically be able to take the vested portion of your 401K Pep account with you. The unvested portion will be forfeited, and you will not be able to access those funds. However, it's essential to review your plan documents to understand the specific rules and procedures for handling unvested funds.

Can I roll over my 401K Pep account to an IRA if I leave my job?

+Yes, you can typically roll over your 401K Pep account to an IRA if you leave your job. However, you should review your plan documents to understand the specific rules and procedures for rolling over your account. Additionally, you may want to consult with a financial advisor to determine the best course of action for your individual circumstances.

In conclusion, 401K Pep vesting is an essential aspect of retirement planning that employees should carefully consider. By understanding the vesting schedule and how it applies to their situation, employees can make informed decisions about their retirement savings and ensure that they are maximizing their benefits. It’s crucial for employees to review their plan documents carefully and seek professional advice if needed to ensure that they are making the most of their 401K Pep plan.