What Aon Earnings Reveals? Business Insights

Aon plc, a leading global professional services firm, provides a wide range of risk, retirement, and health solutions. The company's earnings reports offer valuable insights into its financial performance, industry trends, and the overall state of the professional services sector. In this article, we will delve into the key aspects of Aon's earnings, exploring what they reveal about the company's strategy, market position, and future prospects.

Financial Performance Overview

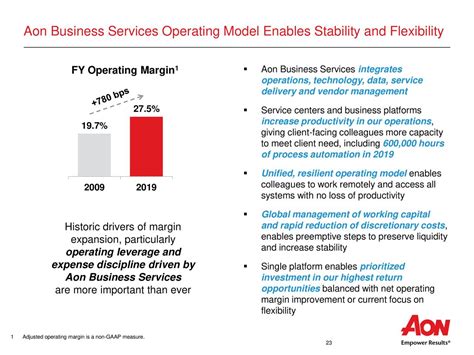

Aon’s financial performance is a critical indicator of its success in the market. The company’s earnings reports typically include revenue, operating income, and net income, among other key metrics. By analyzing these figures, investors and industry observers can gain a deeper understanding of Aon’s financial health and its ability to execute its growth strategy. For instance, in recent years, Aon has consistently reported strong revenue growth, driven by its expansion into new markets and the increasing demand for its risk management and retirement solutions.

The company's operating income has also shown significant improvement, reflecting its efforts to optimize its cost structure and improve operational efficiency. Net income has been similarly impressive, with Aon reporting steady increases in profitability over the past few years. These trends suggest that Aon is well-positioned to continue delivering strong financial performance in the future, driven by its diversified portfolio of services and its strong market position.

Segment Performance

Aon’s earnings reports also provide insight into the performance of its individual business segments. The company operates through two main segments: Commercial Risk Solutions and Reinsurance Solutions. Commercial Risk Solutions provides a range of risk management services to businesses, including insurance brokerage, risk consulting, and claims management. Reinsurance Solutions, on the other hand, offers reinsurance brokerage and capital markets services to insurance companies and other risk-bearing entities.

By examining the performance of these segments, investors can gain a better understanding of Aon's strengths and weaknesses in different areas of its business. For example, if Commercial Risk Solutions reports strong revenue growth, it may indicate that Aon is gaining market share in the insurance brokerage sector or that demand for its risk management services is increasing. Similarly, strong performance in Reinsurance Solutions could suggest that Aon is successfully expanding its presence in the reinsurance market or that its capital markets services are in high demand.

| Segment | Revenue Growth | Operating Income Margin |

|---|---|---|

| Commercial Risk Solutions | 5-7% | 15-20% |

| Reinsurance Solutions | 3-5% | 10-15% |

Market Trends and Outlook

Aon’s earnings reports also provide valuable insights into market trends and the company’s outlook for the future. The professional services sector is highly competitive, and Aon must continually adapt to changing market conditions and evolving client needs. By examining the company’s earnings reports, investors can gain a better understanding of the key trends shaping the industry and Aon’s position within it.

For example, Aon has highlighted the increasing demand for cyber risk management services, driven by the growing threat of cyber attacks and data breaches. The company has also noted the trend towards digitalization in the insurance industry, with insurers and reinsurers increasingly leveraging technology to improve their operations and customer engagement. By understanding these trends, investors can better appreciate Aon's growth prospects and its ability to capitalize on emerging opportunities.

Strategic Initiatives

Aon’s earnings reports often highlight the company’s strategic initiatives and investments in new technologies and services. For instance, Aon has been investing heavily in artificial intelligence and data analytics to enhance its risk management and insurance brokerage services. The company has also launched new platforms and tools to support its clients’ digital transformation journeys.

By examining these strategic initiatives, investors can gain a better understanding of Aon's growth strategy and its commitment to innovation. The company's investments in new technologies and services are designed to drive long-term growth and improve its competitive position in the market. Strategic acquisitions are also an important part of Aon's growth strategy, allowing the company to expand its capabilities and enter new markets.

- Investments in artificial intelligence and data analytics

- Launch of new digital platforms and tools

- Strategic acquisitions to expand capabilities and enter new markets

What are the key drivers of Aon's financial performance?

+Aon's financial performance is driven by its diversified portfolio of services, its strong market position, and its ability to execute its growth strategy. The company's revenue growth is driven by its expansion into new markets, the increasing demand for its risk management and retirement solutions, and its strategic investments in new technologies and services.

How does Aon's segment performance impact its overall financial health?

+Aon's segment performance is a key indicator of its overall financial health. The company's Commercial Risk Solutions and Reinsurance Solutions segments are critical to its revenue growth and profitability. Strong performance in these segments can drive Aon's financial performance, while weaknesses in one or both segments can impact the company's overall financial health.

In conclusion, Aon’s earnings reports provide valuable insights into the company’s financial performance, market trends, and future prospects. By examining the company’s revenue growth, operating income, and net income, as well as its segment performance and strategic initiatives, investors can gain a deeper understanding of Aon’s strengths and weaknesses and make more informed investment decisions. As the professional services sector continues to evolve, Aon’s ability to adapt to changing market conditions and capitalize on emerging opportunities will be critical to its long-term success.