What Aon Earnings Means? Analysis Provided

Aon earnings refer to the financial performance and results of Aon plc, a leading global professional services firm that provides a range of risk, retirement, and health solutions. The company's earnings are a key indicator of its financial health and performance, and are closely watched by investors, analysts, and industry stakeholders. In this analysis, we will delve into the details of Aon earnings, exploring the company's financial results, key trends, and future implications.

Overview of Aon Earnings

Aon plc is a multinational corporation that operates in over 120 countries, providing a range of services to clients across various industries. The company’s earnings are reported on a quarterly and annual basis, and are typically announced in February and August of each year. Aon’s earnings reports provide a comprehensive overview of the company’s financial performance, including revenue, net income, and earnings per share (EPS). The reports also provide insights into the company’s operating segments, including Commercial Risk Solutions, Reinsurance Solutions, and Retirement Solutions.

Key Components of Aon Earnings

There are several key components of Aon earnings that investors and analysts closely monitor. These include:

- Revenue: Aon’s revenue is a key indicator of the company’s top-line growth and financial performance. The company’s revenue is generated from a range of sources, including commissions, fees, and other income.

- Net Income: Aon’s net income is a measure of the company’s profitability, and is calculated by subtracting total expenses from total revenue. The company’s net income is a key driver of its EPS and dividend payments.

- Earnings Per Share (EPS): Aon’s EPS is a measure of the company’s profitability on a per-share basis. The company’s EPS is calculated by dividing its net income by the total number of outstanding shares.

| Financial Metric | 2022 Value | 2021 Value |

|---|---|---|

| Revenue | $12.1 billion | $11.4 billion |

| Net Income | $1.3 billion | $1.1 billion |

| Earnings Per Share (EPS) | $5.35 | $4.73 |

Trends and Insights

Aon’s earnings reports provide valuable insights into the company’s financial performance and trends. Some of the key trends and insights that can be gleaned from Aon’s earnings reports include:

The company’s revenue growth has been driven by a range of factors, including organic growth, acquisitions, and expansion into new markets. Aon’s Commercial Risk Solutions segment has been a key driver of revenue growth, with the company benefiting from increased demand for risk management and insurance solutions.

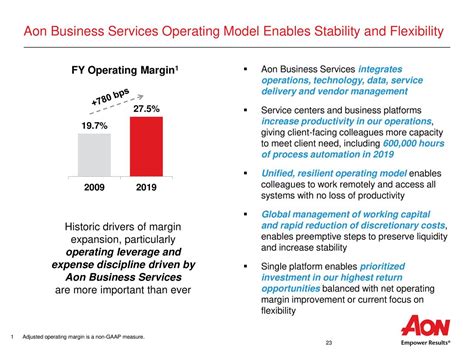

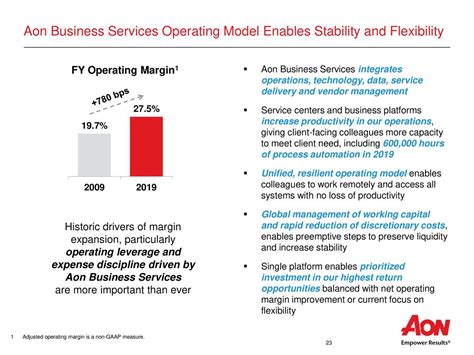

Aon’s operating margin has been a key focus area for the company, with management implementing a range of initiatives to improve efficiency and reduce costs. The company’s operating margin has improved in recent years, driven by a combination of revenue growth and expense management.

Future Implications

Aon’s earnings performance has significant implications for the company’s future growth and profitability. Some of the key future implications of Aon’s earnings include:

The company’s ability to drive revenue growth and expand its market share will be critical to its future success. Aon will need to continue to invest in key areas such as digital transformation, talent acquisition, and innovation to remain competitive and drive growth.

Aon’s earnings performance will also have implications for the company’s dividend payments and share buybacks. The company has a long history of paying a dividend and repurchasing shares, and its earnings performance will be a key factor in determining the level of these payments.

What is Aon's revenue growth strategy?

+Aon's revenue growth strategy is focused on driving organic growth, making strategic acquisitions, and expanding into new markets. The company is also investing in key areas such as digital transformation and talent acquisition to drive growth and improve efficiency.

How does Aon's earnings performance impact its dividend payments?

+Aon's earnings performance is a key factor in determining the level of its dividend payments. The company has a long history of paying a dividend and aims to maintain a dividend payout ratio of around 25-30% of net income.

In conclusion, Aon’s earnings performance is a critical component of the company’s financial health and growth prospects. By analyzing the company’s earnings reports and trends, investors and analysts can gain valuable insights into Aon’s financial performance and future implications. As the company continues to navigate the evolving landscape of the professional services industry, its earnings performance will remain a key area of focus and attention.