What Affects Cyber Insurance Rates 2023? Key Factors

The cost of cyber insurance has become a significant concern for businesses of all sizes in 2023. As the threat landscape continues to evolve, insurance providers are reassessing their risk models, leading to changes in premium rates. Several key factors affect cyber insurance rates, and understanding these can help businesses navigate the complex landscape of cyber risk management. Industry type, company size, and geographic location are among the primary factors influencing cyber insurance premiums. Moreover, the type of cyber insurance policy chosen, including first-party coverage for direct losses and third-party coverage for liability, plays a crucial role in determining rates.

Key Factors Influencing Cyber Insurance Rates in 2023

The cyber insurance market is dynamic, with rates fluctuating based on various factors. Claims history is a significant factor, as companies with a history of cyberattacks or data breaches are considered higher risks. Additionally, the level of cybersecurity measures implemented by a company can significantly impact premiums. Companies with robust cybersecurity protocols, such as multi-factor authentication, regular software updates, and employee training programs, are likely to receive lower rates. The type of data a company handles also affects rates, with those handling sensitive data, such as financial information or personal identifiable information, facing higher premiums.

Impact of Industry and Company Size

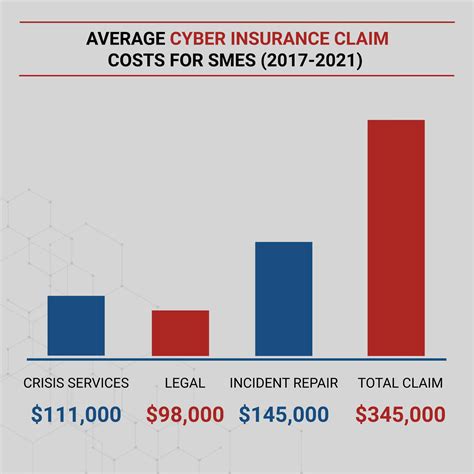

Different industries face varying levels of cyber risk, which is reflected in their insurance premiums. For instance, healthcare and finance sectors, which handle highly sensitive data, tend to have higher premiums compared to other industries. Company size is another crucial factor, as larger companies are generally at a higher risk of cyberattacks due to their size and complexity. Small and medium-sized enterprises (SMEs) might find it challenging to afford comprehensive cyber insurance due to limited budgets, making it essential for them to prioritize their cybersecurity investments wisely.

| Industry Type | Average Premium Increase 2023 |

|---|---|

| Healthcare | 25% |

| Finance | 20% |

| Technology | 15% |

| Manufacturing | 10% |

Geographic Location and Regulatory Environment

The geographic location of a company also influences its cyber insurance rates. Companies operating in regions with strict data protection laws, such as the European Union with its General Data Protection Regulation (GDPR), may face higher premiums due to the potential for significant fines in the event of a data breach. Furthermore, the regulatory environment in which a company operates can impact its cyber risk profile. Compliance with regulations such as GDPR and CCPA (California Consumer Privacy Act) is crucial, as non-compliance can lead to increased premiums and legal liabilities.

In addition to these factors, the reputation of the insurance provider and the level of customer support they offer are important considerations for businesses. A provider with a strong reputation for handling cyber insurance claims efficiently and offering comprehensive support can provide peace of mind, even if their premiums are slightly higher than those of competitors.

Future Implications and Strategies for Businesses

As the cyber threat landscape continues to evolve, businesses must stay vigilant and adapt their strategies to mitigate risks. Investing in cybersecurity is not just a compliance issue but a business imperative. Companies should regularly assess their cyber risk posture and adjust their insurance coverage accordingly. Moreover, cybersecurity awareness training for employees can significantly reduce the risk of human error leading to cyber breaches. By taking proactive measures, businesses can not only reduce their cyber insurance premiums but also protect their reputation and financial well-being.

Evidence-Based Future Implications

Research indicates that the demand for cyber insurance is expected to increase, driven by the growing awareness of cyber risks among businesses. As a result, the cyber insurance market is likely to become more competitive, with insurance providers offering more tailored policies to meet the specific needs of different industries and company sizes. However, this also means that premiums could increase for companies that do not prioritize their cybersecurity, making it essential for businesses to view cybersecurity investments as a long-term strategy rather than a short-term cost.

What are the primary factors that affect cyber insurance rates in 2023?

+The primary factors include industry type, company size, geographic location, claims history, level of cybersecurity measures, and the type of data handled by the company. Additionally, the regulatory environment and compliance with data protection laws can significantly impact premiums.

How can businesses reduce their cyber insurance premiums?

+Businesses can reduce their cyber insurance premiums by implementing robust cybersecurity measures, maintaining a clean claims history, ensuring compliance with relevant regulations, and choosing the right type of cyber insurance policy for their specific needs. Regular cybersecurity audits and employee training programs can also demonstrate a company's commitment to risk mitigation, potentially leading to lower premiums.

What role does the regulatory environment play in cyber insurance rates?

+The regulatory environment plays a significant role in cyber insurance rates. Companies operating in regions with strict data protection laws face higher premiums due to the potential for significant fines in the event of a data breach. Compliance with regulations such as GDPR and CCPA is crucial, as non-compliance can lead to increased premiums and legal liabilities.

In conclusion, the factors affecting cyber insurance rates in 2023 are multifaceted and interconnected. By understanding these factors and taking proactive steps to mitigate cyber risks, businesses can navigate the complex cyber insurance landscape more effectively. Investing in robust cybersecurity measures, ensuring regulatory compliance, and choosing the right insurance policy are critical strategies for managing cyber risk and reducing insurance premiums. As the cyber threat landscape continues to evolve, the importance of these strategies will only continue to grow.