Risk Competition: Reduce Threats

The concept of risk competition refers to the strategic interaction between organizations or individuals seeking to mitigate potential threats and minimize losses. In today's complex and interconnected world, risk competition has become a critical aspect of business strategy, cybersecurity, and global governance. As organizations strive to reduce threats and protect their assets, they must navigate a landscape of competing interests, uncertain outcomes, and evolving risks. This article will delve into the world of risk competition, exploring its key components, strategies, and implications for organizations and individuals seeking to manage and reduce threats.

Understanding Risk Competition

Risk competition involves the interaction of multiple stakeholders, each with their own risk tolerance, priorities, and objectives. In this context, organizations must balance their own risk management strategies with the actions of competitors, regulators, and other external factors. Effective risk management requires a deep understanding of the risk landscape, including the identification, assessment, and mitigation of potential threats. Risk analysis is a critical component of this process, involving the use of statistical models, scenario planning, and other techniques to quantify and prioritize risks.

Risk Competition Strategies

Organizations employ a range of strategies to manage risk and reduce threats, including diversification, hedging, and insurance. Diversification involves spreading risk across multiple assets, investments, or business lines, while hedging involves taking positions in derivatives or other financial instruments to mitigate potential losses. Insurance, on the other hand, involves transferring risk to a third-party provider in exchange for a premium. These strategies can be used individually or in combination to manage risk and reduce threats.

| Risk Management Strategy | Description | Example |

|---|---|---|

| Diversification | Spreading risk across multiple assets or investments | A company invests in a portfolio of stocks, bonds, and real estate to reduce dependence on any one asset class |

| Hedging | Taking positions in derivatives or other financial instruments to mitigate potential losses | A company buys options to hedge against potential losses in its currency exchange transactions |

| Insurance | Transferring risk to a third-party provider in exchange for a premium | A company purchases cyber insurance to protect against potential losses resulting from a data breach |

Risk Competition in Cybersecurity

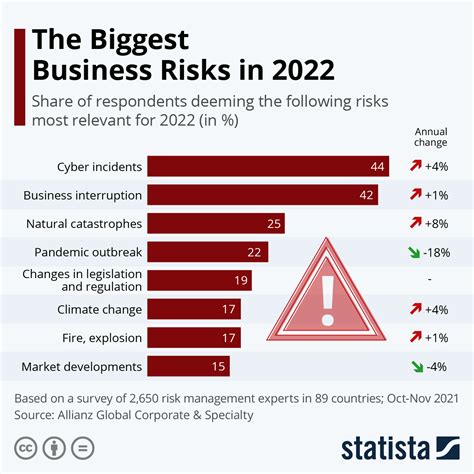

Cybersecurity is a critical area of risk competition, as organizations seek to protect their digital assets and sensitive information from an increasingly sophisticated and evolving threat landscape. Cyber risk management involves the identification, assessment, and mitigation of potential cyber threats, including malware, phishing, and denial-of-service (DoS) attacks. Organizations must balance their own cyber risk management strategies with the actions of competitors, nation-state actors, and other external factors.

Cyber Risk Management Strategies

Organizations employ a range of strategies to manage cyber risk, including network segmentation, incident response planning, and employee training and awareness. Network segmentation involves dividing a network into smaller, isolated segments to reduce the attack surface, while incident response planning involves developing procedures for responding to and containing cyber attacks. Employee training and awareness are critical components of cyber risk management, as employees are often the weakest link in an organization’s cyber defenses.

- Network segmentation: dividing a network into smaller, isolated segments to reduce the attack surface

- Incident response planning: developing procedures for responding to and containing cyber attacks

- Employee training and awareness: educating employees on cyber risks and best practices for mitigating them

What is risk competition, and why is it important for organizations?

+Risk competition refers to the strategic interaction between organizations seeking to mitigate potential threats and minimize losses. It is important for organizations because it allows them to manage and reduce risks, gain a competitive advantage, and protect their assets and reputation.

What are some common risk management strategies used by organizations?

+Common risk management strategies used by organizations include diversification, hedging, and insurance. These strategies can be used individually or in combination to manage risk and reduce threats.

Why is cybersecurity a critical area of risk competition?

+Cybersecurity is a critical area of risk competition because organizations face an increasingly sophisticated and evolving threat landscape. Effective cyber risk management is essential for protecting digital assets and sensitive information, and for maintaining a competitive advantage in the market.

In conclusion, risk competition is a complex and multifaceted phenomenon that requires organizations to navigate a landscape of competing interests, uncertain outcomes, and evolving risks. By understanding the key components of risk competition, including risk analysis, risk management strategies, and cyber risk management, organizations can reduce threats, gain a competitive advantage, and protect their assets and reputation. As the risk landscape continues to evolve, it is essential for organizations to stay ahead of the curve, adapting and innovating their risk management strategies to meet the challenges of a rapidly changing world.