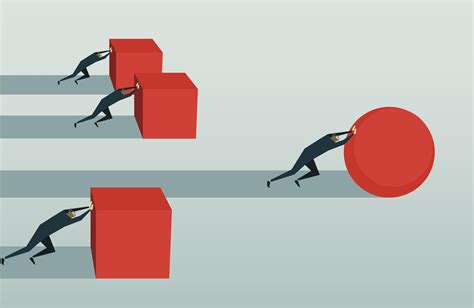

Risk Competition: Beat Opponents

Risk competition is a critical aspect of business strategy, where companies strive to outmaneuver their opponents to gain a competitive edge. In today's fast-paced and dynamic market, the ability to assess and mitigate risks is crucial for survival and success. Businesses that can effectively manage risk are better positioned to capitalize on opportunities, minimize losses, and ultimately outperform their competitors. The concept of risk competition is deeply rooted in the idea that companies must continuously adapt and innovate to stay ahead of the curve, and those that fail to do so risk being left behind.

Understanding Risk Competition

Risk competition refers to the process of identifying, assessing, and mitigating risks to gain a competitive advantage over opponents. This involves a deep understanding of the market, industry trends, and the competitive landscape. Companies must be able to analyze potential risks, prioritize them, and develop strategies to mitigate or capitalize on them. Effective risk management enables businesses to reduce uncertainty, minimize losses, and maximize returns on investment. In a competitive market, companies that can manage risk more effectively than their opponents are more likely to achieve their goals and outperform their peers.

Key Components of Risk Competition

There are several key components of risk competition, including risk assessment, risk mitigation, and risk monitoring. Risk assessment involves identifying potential risks and evaluating their likelihood and potential impact. Risk mitigation involves developing strategies to reduce or eliminate risks, while risk monitoring involves continuously tracking and assessing risks to ensure that they are being effectively managed. Companies must also be able to adapt to changing market conditions and adjust their risk management strategies accordingly.

| Risk Component | Description |

|---|---|

| Risk Assessment | Identifying and evaluating potential risks |

| Risk Mitigation | Developing strategies to reduce or eliminate risks |

| Risk Monitoring | Continuously tracking and assessing risks |

Strategies for Beating Opponents in Risk Competition

To beat opponents in risk competition, companies must develop and implement effective risk management strategies. This involves conducting thorough risk assessments, developing mitigation strategies, and continuously monitoring risks. Companies must also be able to adapt quickly to changing market conditions and adjust their risk management strategies accordingly. Additionally, businesses must be able to analyze their competitors’ risk management strategies and identify areas for improvement.

Best Practices for Risk Competition

There are several best practices for risk competition, including establishing a risk management framework, identifying and prioritizing risks, and developing a risk mitigation plan. Companies must also be able to communicate risk management strategies effectively to stakeholders and continuously monitor and evaluate their risk management strategies. By following these best practices, businesses can reduce risk, minimize losses, and maximize returns on investment.

- Establish a risk management framework

- Identify and prioritize risks

- Develop a risk mitigation plan

- Communicate risk management strategies effectively

- Continuously monitor and evaluate risk management strategies

What is risk competition, and why is it important?

+Risk competition refers to the process of identifying, assessing, and mitigating risks to gain a competitive advantage over opponents. It is important because it enables businesses to reduce uncertainty, minimize losses, and maximize returns on investment, ultimately leading to increased competitiveness and success.

What are the key components of risk competition?

+The key components of risk competition include risk assessment, risk mitigation, and risk monitoring. Companies must be able to identify and evaluate potential risks, develop strategies to reduce or eliminate them, and continuously track and assess risks to ensure that they are being effectively managed.

In conclusion, risk competition is a critical aspect of business strategy that involves identifying, assessing, and mitigating risks to gain a competitive advantage over opponents. By understanding the key components of risk competition, developing effective risk management strategies, and following best practices, businesses can reduce risk, minimize losses, and maximize returns on investment, ultimately leading to increased competitiveness and success.

Future Implications of Risk Competition

The future of risk competition will be shaped by emerging trends and technologies, such as artificial intelligence and machine learning. These technologies will enable businesses to analyze and manage risk more effectively, but they will also create new risks and challenges. Companies must be able to adapt to these changes and develop new risk management strategies to remain competitive. Additionally, the increasing complexity of global supply chains and the growing importance of cybersecurity will require businesses to develop more sophisticated risk management strategies.

Emerging Trends in Risk Competition

There are several emerging trends in risk competition, including the use of data analytics and predictive modeling to identify and mitigate risks. Companies are also using cloud computing and internet of things (IoT) technologies to monitor and manage risk in real-time. Additionally, the growing importance of environmental, social, and governance (ESG) factors will require businesses to develop more sustainable and responsible risk management strategies.

| Trend | Description |

|---|---|

| Data Analytics | Using data analytics to identify and mitigate risks |

| Predictive Modeling | Using predictive modeling to forecast and manage risk |

| Cloud Computing | Using cloud computing to monitor and manage risk in real-time |