Nyse: Aon

Aon plc, listed on the New York Stock Exchange (NYSE) under the ticker symbol AON, is a multinational professional services firm that provides a wide range of risk, retirement, and health solutions to clients around the world. Founded in 1982 by Patrick Ryan, Aon has evolved through strategic acquisitions and expansions to become one of the largest insurance brokerage and consulting firms globally.

History and Evolution of Aon

Aon’s history is marked by significant mergers and acquisitions that have shaped the company into its current form. One of the pivotal moments in Aon’s history was its merger with Combined Insurance Company of America in 1987, which expanded its operations into new markets. The acquisition of Alexander & Alexander Services Inc. in 1997 further solidified Aon’s position as a leading insurance brokerage firm. Over the years, Aon has continued to grow through strategic acquisitions, enhancing its capabilities in areas such as risk management, human capital consulting, and investment banking.

Business Segments and Services

Aon operates through several business segments, including Commercial Risk Solutions, Reinsurance Solutions, Retirement Solutions, and Health Solutions. The Commercial Risk Solutions segment offers retail brokerage services, including property, casualty, and specialty insurance, as well as risk management services. The Reinsurance Solutions segment provides treaty and facultative reinsurance, capital markets, and insurance-related services. Retirement Solutions offers consulting and advisory services to help clients manage their retirement plans and schemes, while Health Solutions provides health and benefits consulting and brokerage services. This diversified service portfolio allows Aon to cater to a broad range of client needs, from risk management and insurance to health and retirement planning.

| Business Segment | Description |

|---|---|

| Commercial Risk Solutions | Retail brokerage services, including property, casualty, and specialty insurance |

| Reinsurance Solutions | Treaty and facultative reinsurance, capital markets, and insurance-related services |

| Retirement Solutions | Consulting and advisory services for retirement plans and schemes |

| Health Solutions | Health and benefits consulting and brokerage services |

Key Highlights of Aon's operations include its extensive global network, with operations in over 120 countries, and its commitment to innovation, with investments in digital platforms and data analytics to enhance client service delivery. Risk management, a critical aspect of Aon's services, involves the identification, assessment, and mitigation of risks that could impact clients' businesses. This is achieved through a combination of insurance solutions, consulting services, and technology-enabled platforms. Aon's consulting capabilities are another significant strength, providing clients with expert advice on managing their risks, optimizing their benefits programs, and improving their overall business performance.

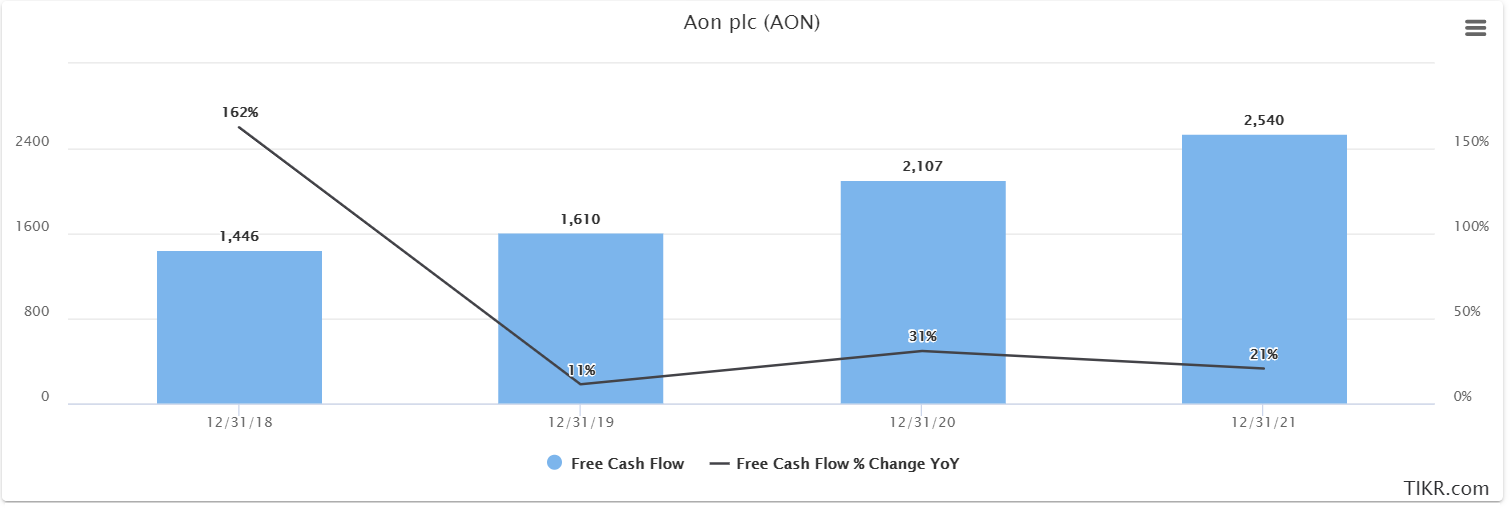

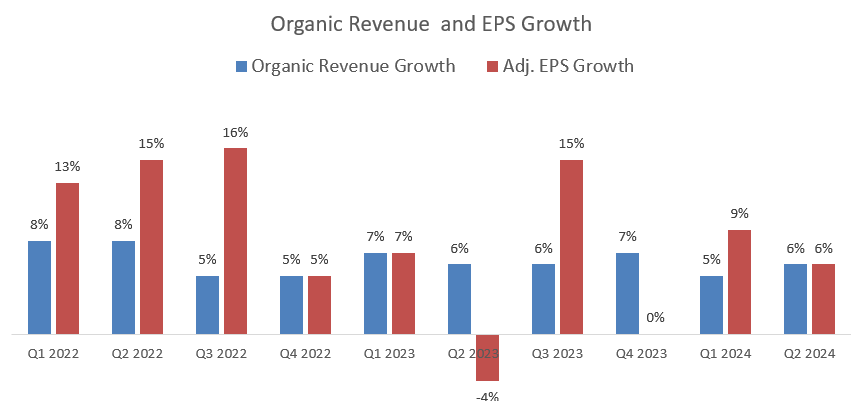

Financial Performance and Market Presence

Aon has consistently demonstrated strong financial performance, with revenues and net income showing steady growth over the years. The company’s diversified revenue streams, stemming from its various business segments, contribute to its financial stability and resilience. Aon’s market presence is also significant, with the company being one of the largest insurance brokerage and consulting firms globally. Its global network and extensive range of services make it a preferred partner for clients seeking comprehensive risk management and benefits solutions.

In terms of market share, Aon is a leading player in the insurance brokerage market, competing with other major firms such as Marsh & McLennan and Willis Towers Watson. The company's ability to innovate and adapt to changing market conditions, including the increasing use of digital technologies in insurance and risk management, is crucial for maintaining its competitive edge. Aon's strategic partnerships and collaborations with technology companies and startups further enhance its capabilities in areas such as data analytics and cybersecurity.

Challenges and Future Outlook

Despite its strengths, Aon faces challenges in the rapidly evolving insurance and consulting landscape. Regulatory changes, such as those related to data privacy and cybersecurity, require Aon to invest in compliance and risk management. The digitization of insurance services also presents both opportunities and challenges, as Aon must balance the benefits of digital platforms with the need to maintain high-quality, personalized service delivery. Furthermore, global economic uncertainties can impact demand for insurance and consulting services, necessitating Aon to be agile and responsive to changing client needs.

| Challenge | Impact on Aon |

|---|---|

| Regulatory Changes | Requires investment in compliance and risk management |

| Digitization of Insurance Services | Presents opportunities for growth but also requires balance with personalized service delivery |

| Global Economic Uncertainties | Demands agility and responsiveness to changing client needs |

What are Aon’s main business segments?

+Aon operates through four main business segments: Commercial Risk Solutions, Reinsurance Solutions, Retirement Solutions, and Health Solutions.

How does Aon approach risk management for its clients?

+Aon approaches risk management through a combination of insurance solutions, consulting services, and technology-enabled platforms, helping clients identify, assess, and mitigate risks that could impact their businesses.

What are some of the challenges facing Aon in the current market landscape?

+Aon faces challenges such as regulatory changes, the digitization of insurance services, and global economic uncertainties, which require the company to be innovative, agile, and responsive to changing client needs.