Manchester United Shareholders

Manchester United, one of the most renowned and successful football clubs in the world, has a complex shareholder structure that has evolved over the years. As of my last update in January 2023, the club's ownership and shareholder landscape is as follows.

The Glazer Family: Majority Shareholders

The Glazer family, led by Joel and Avram Glazer, holds the majority stake in Manchester United. They acquired the club in 2005 through a leveraged buyout, which involved borrowing money to finance the purchase. The Glazers own approximately 74% of the club’s shares, making them the primary decision-makers and influencers in the club’s operations.

The Glazers' acquisition of Manchester United was not without controversy. The leveraged buyout structure led to significant debt being placed on the club, which some fans and analysts believed could impact the club's long-term financial health and ability to invest in player transfers and infrastructure.

Key Members of the Glazer Family:

- Joel Glazer: Co-chairman and one of the key figures in the family’s ownership. He is also the vice-chairman of the NFL’s Tampa Bay Buccaneers, another sports franchise owned by the Glazers.

- Avram Glazer: Co-chairman and brother of Joel. He is also a director of the Buccaneers and has been involved in several business ventures related to sports and media.

- Bryan Glazer: One of the sons of Malcolm Glazer, the patriarch of the family who initially led the acquisition of Manchester United. Bryan serves as a director of the Buccaneers and is involved in the family’s business interests.

- Kevin Glazer: Another son of Malcolm Glazer and a director of the Buccaneers. He is known for his involvement in various philanthropic initiatives and has a background in finance.

- Darcie Glazer Kassewitz: Daughter of Malcolm Glazer and a director of the Buccaneers. She is involved in the family’s business operations and has a passion for horse breeding and showing.

- Edward Glazer: Son of Malcolm Glazer and a director of the Buccaneers. He is actively involved in the family’s business ventures and has a background in real estate.

Public Shareholders and the New York Stock Exchange

In addition to the Glazer family’s majority stake, a portion of Manchester United’s shares are publicly traded on the New York Stock Exchange (NYSE) under the ticker symbol “MANU.” This means that a significant number of shareholders are individual investors and institutions who have purchased shares on the open market.

By listing on the NYSE, Manchester United gained access to a global investor base and increased its financial flexibility. However, it also meant that the club's financial performance and strategic decisions became more transparent and subject to market scrutiny.

Key Public Shareholders (as of January 2023):

- BlackRock, Inc.: One of the world’s largest asset managers, BlackRock holds a significant stake in Manchester United. As of my last update, they owned approximately 5.4% of the club’s shares.

- Vanguard Group, Inc.: Another prominent asset management firm, Vanguard is also a notable shareholder in Manchester United. They owned around 4.5% of the club’s shares as of January 2023.

- State Street Corporation: State Street, a leading financial services company, holds a smaller stake in Manchester United. They owned approximately 1.8% of the club’s shares as of my last update.

- Other Institutional and Individual Investors: Numerous other institutional investors and individual shareholders hold smaller stakes in Manchester United. These include pension funds, hedge funds, and retail investors who have purchased shares on the open market.

Manchester United’s Shareholder Structure and Performance

Manchester United’s shareholder structure has had a significant impact on the club’s financial performance and strategic decisions. The Glazer family’s ownership has brought both benefits and challenges.

On the one hand, the Glazers have invested in the club's infrastructure, including the construction of the state-of-the-art Aon Training Complex and various commercial initiatives. They have also successfully navigated the club through the financial challenges posed by the COVID-19 pandemic.

However, the high levels of debt associated with the leveraged buyout have been a source of concern for many fans and analysts. The club's financial obligations have sometimes limited its ability to invest in the playing squad, leading to periods of reduced competitiveness on the pitch.

Financial Performance and Market Valuation:

| Metric | Value |

|---|---|

| Market Capitalization | £3.66 billion (as of January 2023) |

| Revenue | £581.2 million (2021-2022 season) |

| Operating Profit | £21.7 million (2021-2022 season) |

| Net Debt | £491.1 million (as of June 30, 2022) |

Fan Ownership and the Manchester United Supporters’ Trust

In response to the Glazers’ leveraged buyout and concerns about the club’s financial management, a group of fans formed the Manchester United Supporters’ Trust (MUST) in 2005. MUST aims to represent the interests of supporters and promote fan ownership and involvement in the club’s governance.

MUST has been vocal in its criticism of the Glazers' ownership, particularly regarding the high levels of debt and the perception that the club's financial priorities are misaligned with those of the fans. The trust has advocated for a fan-led review of football governance and has called for greater transparency and accountability from the club's ownership.

Key Initiatives and Achievements of MUST:

- MUST has successfully campaigned for a “Fans’ Share Scheme,” allowing supporters to purchase shares in the club. While the scheme is small-scale, it represents a step towards greater fan ownership and involvement.

- The trust has also been active in promoting fan engagement and consultation, working with the club to ensure that supporter voices are heard in key decision-making processes.

- MUST has played a role in raising awareness about the financial challenges faced by supporters, including the impact of ticket prices and the need for affordable access to matches.

Future Prospects and Potential Changes in Shareholder Structure

The future of Manchester United’s shareholder structure remains uncertain. While the Glazer family has shown no immediate signs of selling their majority stake, there have been rumors and speculations about potential interest from other investors.

In recent years, there have been reports of interest from various parties, including Saudi Arabia's Public Investment Fund and American billionaire Stephen Ross. However, no concrete deals have materialized, and the Glazers have consistently stated their commitment to the club's long-term success.

The club's financial performance and on-field results will likely be key factors in shaping the future of its shareholder structure. A sustained period of success could enhance the club's market value and potentially attract new investors, while continued underperformance might lead to increased pressure on the Glazers to consider alternative ownership models.

Potential Future Scenarios:

- Continued Glazer Ownership: The Glazers maintain their majority stake and continue to guide the club’s strategic direction, focusing on commercial growth and financial stability.

- Partial Sale of Stake: The Glazers could decide to sell a portion of their shares to raise capital or bring in new investors, potentially leading to a more diverse shareholder structure.

- Complete Sale: In an extreme scenario, the Glazers might decide to sell their entire stake, leading to a change in ownership and potentially a new direction for the club.

Conclusion

Manchester United’s shareholder structure is a complex and dynamic aspect of the club’s operations. The Glazer family’s majority ownership has brought both financial stability and challenges, while the involvement of public shareholders and the advocacy of fan groups like MUST have added layers of complexity.

As the club navigates the ever-evolving landscape of global football, its shareholder structure will continue to be a key factor in shaping its future. The balance between financial success, on-field performance, and fan engagement will be crucial in determining the long-term direction of one of the world's most iconic football clubs.

What is the history of Manchester United’s ownership before the Glazers?

+Before the Glazers, Manchester United was owned by a consortium led by Irish businessman and racehorse owner John Magnier, who acquired the club in 1991. Magnier and his partners, including football club chairman Martin Edwards, owned the club until 2003 when they sold their majority stake to British businessman Malcolm Glazer.

How has the Glazer family’s ownership impacted Manchester United’s financial performance?

+The Glazer family’s ownership has had a significant impact on Manchester United’s financial performance. While the club has achieved commercial success and increased its global brand value, the high levels of debt associated with the leveraged buyout have limited its ability to invest in the playing squad, leading to periods of reduced competitiveness on the pitch.

What is the role of the Manchester United Supporters’ Trust (MUST) in the club’s governance?

+The Manchester United Supporters’ Trust (MUST) is a fan-led organization that aims to represent the interests of supporters and promote fan ownership and involvement in the club’s governance. MUST has been vocal in its criticism of the Glazers’ ownership and has advocated for a fan-led review of football governance, calling for greater transparency and accountability.

Related Terms:

- 2Arsenal

- 4Manchester City

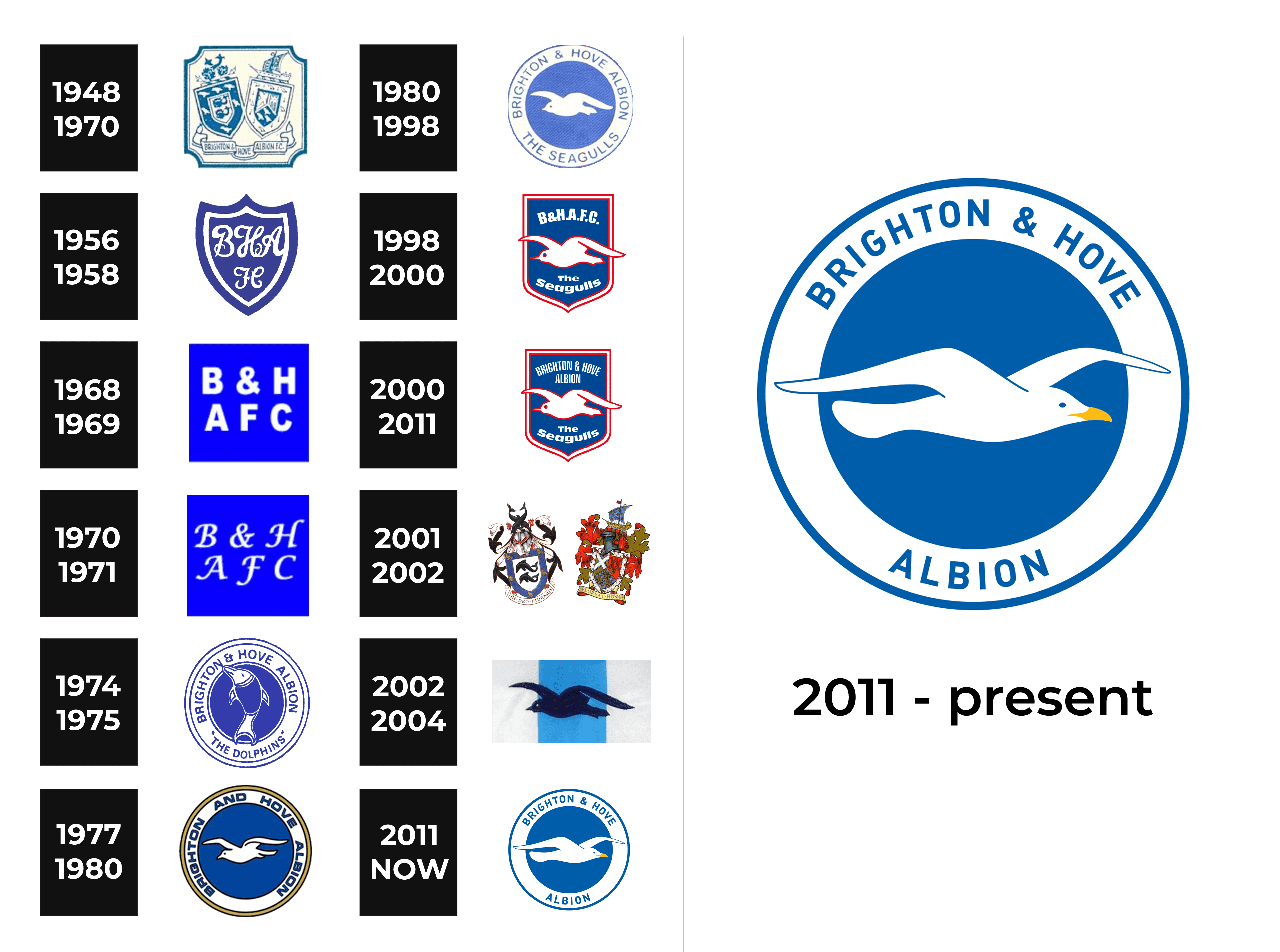

- 6Brighton and Hove Albion

- 8Newcastle United

- 10Fulham

- 12Brentford