Indemnity Insurance Help

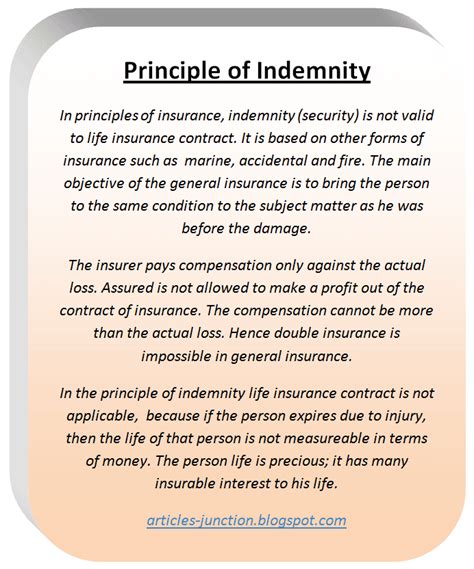

Indemnity insurance is a type of insurance policy that provides financial protection to individuals or organizations against potential losses or damages. It is designed to reimburse the policyholder for any expenses or liabilities incurred as a result of a specific event or circumstance. In this article, we will delve into the world of indemnity insurance, exploring its various types, benefits, and applications.

What is Indemnity Insurance?

Indemnity insurance is a broad term that encompasses a range of insurance policies, including professional indemnity, public liability, and employers’ liability insurance. The primary purpose of indemnity insurance is to provide financial protection against unforeseen events, such as accidents, errors, or omissions, that may result in financial losses or damage to reputation. Professional indemnity insurance, for instance, is designed to protect professionals, such as doctors, lawyers, and accountants, against claims of negligence or malpractice.

Types of Indemnity Insurance

There are several types of indemnity insurance policies available, each catering to specific needs and industries. Some of the most common types of indemnity insurance include:

- Professional indemnity insurance: designed for professionals who provide advice or services

- Public liability insurance: provides protection against claims from the public for accidents or injuries

- Employers' liability insurance: mandatory for employers to protect against employee claims for work-related injuries or illnesses

- Directors and officers liability insurance: protects company directors and officers against claims of mismanagement or breach of duty

- Cyber liability insurance: designed to protect against cyber-attacks and data breaches

Each type of indemnity insurance policy has its unique features and benefits, and it is essential to understand the specifics of each policy to ensure adequate protection.

Benefits of Indemnity Insurance

Indemnity insurance offers numerous benefits to individuals and organizations, including:

Financial protection: indemnity insurance provides a safety net against unexpected expenses or liabilities, helping to mitigate financial losses. Reimbursement for expenses incurred as a result of a claim can be a significant relief, allowing policyholders to focus on their core business activities.

Reputation protection: indemnity insurance can help protect a policyholder's reputation by providing a means to respond to claims and allegations in a professional and timely manner. This can be particularly important for professionals and organizations that rely on their reputation to attract clients or customers.

Compliance: in some cases, indemnity insurance may be mandatory, such as employers' liability insurance. Having the right insurance policy in place can help ensure compliance with regulatory requirements and avoid potential fines or penalties.

Applications of Indemnity Insurance

Indemnity insurance has a wide range of applications across various industries and sectors. Some examples include:

| Industry | Type of Indemnity Insurance |

|---|---|

| Healthcare | Professional indemnity insurance for medical professionals |

| Finance | DIRECTORS AND OFFICERS LIABILITY INSURANCE FOR COMPANY DIRECTORS |

| Technology | Cyber liability insurance for companies that handle sensitive data |

| Construction | Public liability insurance for construction companies |

These are just a few examples of the many applications of indemnity insurance. The specific type of insurance required will depend on the industry, business activities, and level of risk involved.

Indemnity Insurance Claims

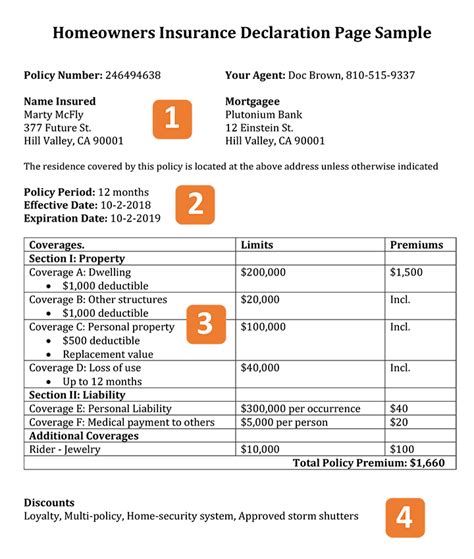

Making a claim on an indemnity insurance policy can be a complex process, and it is crucial to follow the correct procedures to ensure a successful outcome. Notification of a potential claim should be made to the insurer as soon as possible, and policyholders should be prepared to provide detailed information and documentation to support their claim.

Investigation of the claim will typically involve an assessment of the circumstances surrounding the event or incident, as well as a review of the policy terms and conditions. The insurer will then determine the extent of their liability and the amount of any payout or reimbursement.

Indemnity Insurance Premiums

The cost of indemnity insurance premiums can vary significantly depending on a range of factors, including the type of policy, level of cover, and industry or profession. Risk assessment is a critical component of the premium calculation process, with insurers taking into account factors such as the policyholder’s claims history, business activities, and level of exposure to potential risks.

Other factors that can influence indemnity insurance premiums include:

- Policy limits and excess

- Industry or profession

- Location and geographical factors

- Claims history and risk profile

What is the difference between indemnity insurance and liability insurance?

+Indemnity insurance and liability insurance are often used interchangeably, but they have distinct meanings. Indemnity insurance refers to a type of insurance that provides financial protection against potential losses or damages, while liability insurance specifically provides protection against claims of negligence or wrongdoing.

How do I choose the right indemnity insurance policy for my business?

+Choosing the right indemnity insurance policy for your business involves carefully considering your specific needs and requirements. This includes assessing your level of risk exposure, understanding the types of policies available, and reviewing the terms and conditions of each policy. It is also essential to seek professional advice from a qualified insurance broker or advisor.

Can I purchase indemnity insurance online?

+Yes, it is possible to purchase indemnity insurance online. Many insurance companies and brokers offer online quote and application facilities, allowing policyholders to quickly and easily compare prices and purchase a policy. However, it is essential to carefully review the policy terms and conditions before making a purchase, and to seek professional advice if necessary.