How To Trade Aon Stock? Beginner Guide

Aon stock, listed under the ticker symbol AON, represents shares in Aon plc, a leading global professional services firm providing a range of risk, retirement, and health solutions. For individuals looking to trade Aon stock, understanding the basics of stock trading, the company's performance, and market dynamics is essential. This guide is designed to walk beginners through the process of trading Aon stock, providing a comprehensive overview of the steps involved and key considerations.

Understanding Aon plc

Aon plc is a multinational corporation that operates in the professional services sector, focusing on risk management, insurance brokerage, and human resources consulting. The company’s diverse portfolio and global presence make its stock an attractive option for investors seeking stable, long-term growth opportunities. Before trading Aon stock, it’s crucial to have a solid understanding of the company’s financial health, industry trends, and potential risks.

Financial Performance and Trends

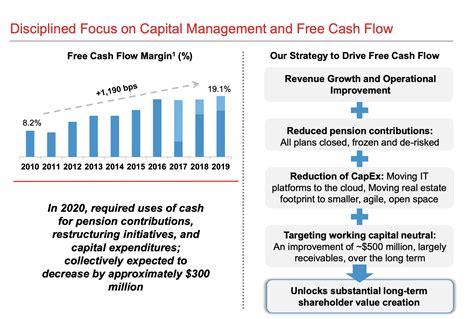

Aon’s financial performance can be evaluated by analyzing its quarterly and annual earnings reports, which provide insights into revenue growth, profitability, and cash flow. Trends in the insurance and professional services sectors, such as changes in regulatory environments, technological advancements, and shifts in client needs, can also impact Aon’s stock performance. Revenue growth, operating margins, and dividend payouts are key metrics to monitor when assessing Aon’s financial health.

The company's ability to adapt to market changes, invest in digital transformation, and expand its services portfolio are critical factors influencing its long-term success. Risk management strategies, including diversification of services and geographical expansion, play a significant role in Aon's resilience to economic downturns and its ability to capitalize on growth opportunities.

How to Trade Aon Stock

Trading Aon stock involves several steps, from opening a brokerage account to executing trades. The following guide provides a detailed walkthrough of the process:

- Choose a Brokerage Account: Select a reputable online brokerage firm that offers competitive fees, robust trading platforms, and excellent customer service. Consider factors such as account minimums, trading commissions, and the range of investment products available.

- Open and Fund Your Account: Once you've selected a brokerage firm, proceed to open an account. This typically involves providing personal and financial information, and funding your account via bank transfer, wire transfer, or other accepted methods.

- Research and Select Your Trading Strategy: Determine your investment goals and risk tolerance to decide on a trading strategy. This could involve long-term investing, day trading, or a combination of both. Consider consulting with a financial advisor or conducting your own research to inform your strategy.

- Place Your Trade: Use your brokerage account's trading platform to place an order for Aon stock. You can choose from various order types, such as market orders, limit orders, or stop-loss orders, depending on your strategy and market conditions.

Types of Trades and Orders

Understanding the different types of trades and orders is vital for effectively trading Aon stock. Market orders execute trades at the current market price, while limit orders allow you to specify a price at which you’re willing to buy or sell. Stop-loss orders can help limit potential losses by automatically selling a stock when it falls to a certain price. Familiarizing yourself with these and other order types can help you manage risk and optimize your trading strategy.

| Order Type | Description |

|---|---|

| Market Order | Executes a trade at the current market price |

| Limit Order | Executes a trade at a specified price or better |

| Stop-Loss Order | Automatically sells a stock when it falls to a specified price |

Risk Management and Performance Analysis

Risk management is a critical aspect of trading Aon stock, as it involves mitigating potential losses while maximizing gains. Diversification, position sizing, and stop-loss strategies are key risk management techniques. Regularly analyzing the performance of your trades and adjusting your strategy as needed can help you navigate market volatility and achieve your investment goals.

A thorough performance analysis involves evaluating metrics such as return on investment (ROI), annualized returns, and Sharpe ratio. These metrics provide insights into the profitability and risk-adjusted performance of your trades, allowing you to refine your strategy and make informed decisions.

Future Implications and Industry Outlook

The future of Aon stock is closely tied to the overall performance of the professional services sector and the company’s ability to innovate and expand its offerings. Trends such as digital transformation, artificial intelligence (AI) adoption, and cybersecurity concerns are likely to play significant roles in shaping the industry’s landscape. As a trader, staying abreast of these developments and their potential impact on Aon’s stock performance is essential for making strategic investment decisions.

What are the benefits of trading Aon stock?

+Trading Aon stock offers the potential for long-term growth, dividend income, and the opportunity to invest in a diversified professional services firm with a global presence. Aon's stable financial performance and commitment to innovation make its stock an attractive option for investors seeking reliability and growth opportunities.

How do I stay informed about Aon stock performance and market trends?

+To stay informed, you can follow financial news outlets, analyze earnings reports, and utilize online trading platforms that offer real-time market data and research tools. Additionally, setting up news alerts and following industry experts can provide valuable insights and help you stay ahead of market trends.

In conclusion, trading Aon stock requires a comprehensive understanding of the company’s financials, industry trends, and market dynamics. By following the steps outlined in this guide, staying informed about market developments, and employing effective risk management strategies, you can navigate the process of trading Aon stock with confidence. Remember, investing in the stock market involves risks, and it’s essential to conduct thorough research and consider your investment goals and risk tolerance before making any trading decisions.