How To Track Aon Insurance Claim Status?

Aon is a leading global professional services firm providing a broad range of risk, retirement, and health solutions. For individuals and businesses that have filed an insurance claim with Aon, tracking the status of the claim is crucial to understand the progress and anticipate the outcome. In this article, we will provide a comprehensive guide on how to track an Aon insurance claim status, including the various methods available, the information required, and the benefits of efficient claim tracking.

Methods to Track Aon Insurance Claim Status

There are several methods to track the status of an Aon insurance claim, each with its own advantages and requirements. The most common methods include:

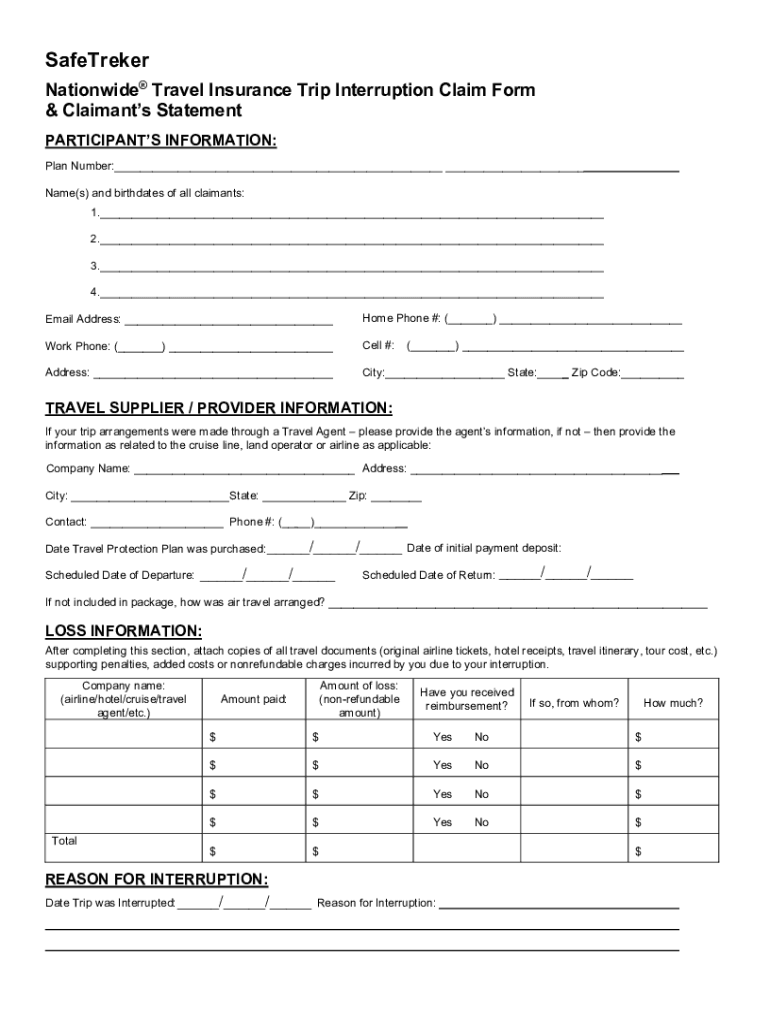

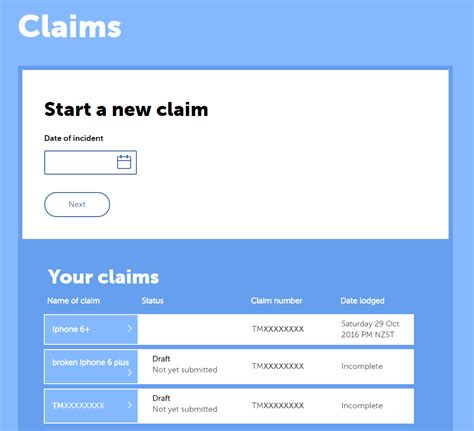

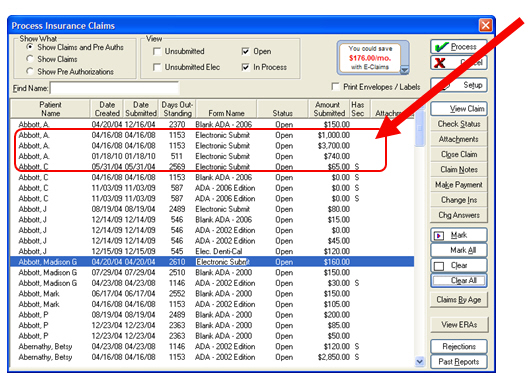

- Online Portal: Aon provides an online portal where policyholders can log in to track the status of their claims. To access the portal, policyholders need to register and create an account, which typically requires their policy number, date of birth, and other personal details.

- Phone: Policyholders can contact Aon's customer service department directly to inquire about the status of their claim. The phone number is usually available on the company's website or on the policy documents.

- Email: Policyholders can also send an email to Aon's claims department to request an update on their claim status. The email should include the policy number, claim number, and a brief description of the inquiry.

- Mobile App: Some insurance companies, including Aon, offer mobile apps that allow policyholders to track their claims on-the-go. The app typically requires registration and login credentials to access the claim information.

Information Required to Track Aon Insurance Claim Status

To track the status of an Aon insurance claim, policyholders typically need to provide some personal and claim-related information. This may include:

| Information | Description |

|---|---|

| Policy Number | The unique identifier assigned to the policy |

| Claim Number | The unique identifier assigned to the claim |

| Date of Birth | The policyholder's date of birth |

| Contact Information | The policyholder's phone number, email, or mailing address |

Benefits of Efficient Claim Tracking

Efficient claim tracking is crucial to ensure that policyholders receive timely and accurate updates on their claims. The benefits of efficient claim tracking include:

- Reduced Anxiety: Policyholders can stay informed about the progress of their claim, reducing anxiety and uncertainty.

- Improved Communication: Efficient claim tracking enables policyholders to communicate effectively with the insurance company, ensuring that all parties are informed and aligned.

- Faster Resolution: By tracking the claim status, policyholders can identify potential delays or issues and work with the insurance company to resolve them promptly.

Common Issues with Claim Tracking

Despite the advantages of efficient claim tracking, policyholders may encounter some common issues, including:

- Technical Difficulties: Online portals or mobile apps may experience technical issues, making it challenging to access claim information.

- Information Discrepancies: Policyholders may encounter discrepancies in their claim information, which can lead to delays or errors in processing the claim.

- Communication Breakdowns: Policyholders may experience communication breakdowns with the insurance company, leading to misunderstandings or misinterpretations of claim status.

What is the typical turnaround time for an Aon insurance claim?

+The typical turnaround time for an Aon insurance claim varies depending on the type of claim, the complexity of the issue, and the availability of required documentation. However, policyholders can typically expect to receive an update on their claim status within 3-5 business days.

Can I track my Aon insurance claim status without registering for an online account?

+Yes, policyholders can track their Aon insurance claim status without registering for an online account by contacting the customer service department directly via phone or email. However, registering for an online account provides policyholders with convenient access to their claim information and updates.

In conclusion, tracking an Aon insurance claim status is a straightforward process that can be done through various methods, including online portals, phone, email, and mobile apps. By providing the required information and using the available tracking methods, policyholders can stay informed about the progress of their claim and ensure a timely and efficient resolution.