How To Manage Tax Liability? Stress Free

Managing tax liability is a crucial aspect of personal and business financial planning. Tax liability refers to the amount of taxes an individual or business owes to the government. Effective tax management can help reduce stress and ensure compliance with tax laws. In this article, we will explore the various strategies and techniques for managing tax liability in a stress-free manner.

Understanding Tax Liability

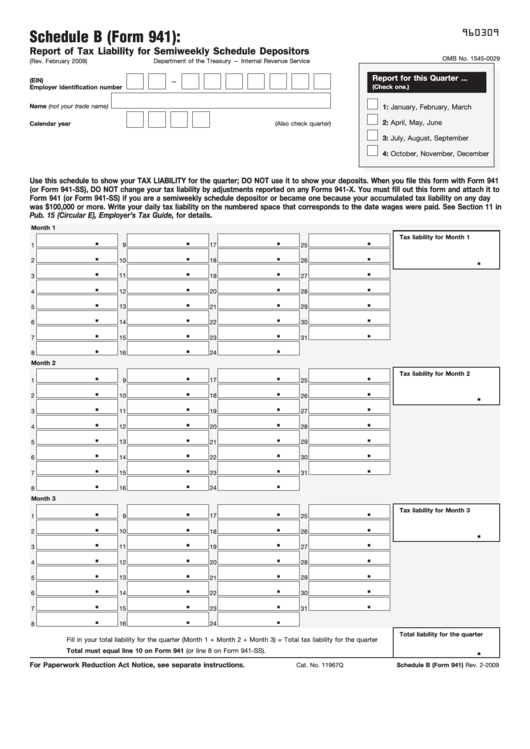

Tax liability is determined by the tax authorities based on an individual’s or business’s income, deductions, and credits. It is essential to understand the tax laws and regulations that apply to your specific situation to minimize tax liability. Tax planning involves analyzing your financial situation, identifying tax-saving opportunities, and implementing strategies to reduce tax liability. Tax deductions and tax credits are two primary ways to reduce tax liability.

Tax Deductions and Credits

Tax deductions are expenses that can be subtracted from taxable income, reducing tax liability. Examples of tax deductions include charitable donations, mortgage interest, and medical expenses. Tax credits, on the other hand, are direct reductions to tax liability. Examples of tax credits include the earned income tax credit and the child tax credit. It is essential to keep accurate records of tax-related expenses and income to maximize tax deductions and credits.

| Tax Deduction/Credit | Description | Benefit |

|---|---|---|

| Charitable Donations | Deduction for donations to qualified charitable organizations | Reduces taxable income |

| Mortgage Interest | Deduction for interest paid on a primary residence | Reduces taxable income |

| Earned Income Tax Credit | Credit for low-to-moderate income working individuals and families | Reduces tax liability |

Tax Planning Strategies

Tax planning involves implementing strategies to minimize tax liability. Some common tax planning strategies include:

- Tax-deferred savings: Utilizing tax-deferred savings vehicles such as 401(k) or IRA accounts to reduce taxable income.

- Tax-loss harvesting: Selling securities that have declined in value to offset gains from other investments.

- Bunching deductions: Grouping deductions into a single year to maximize tax savings.

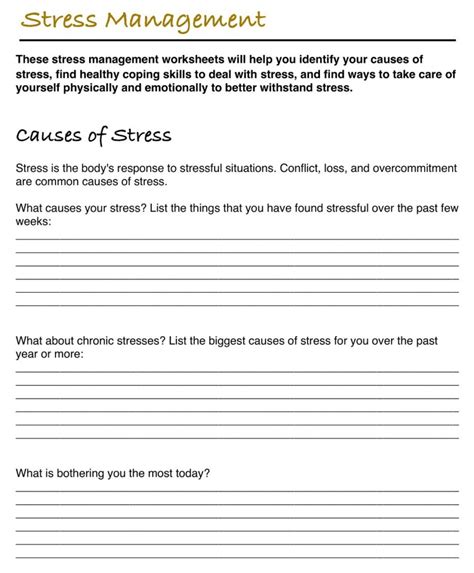

Tax Audit Preparation

In the event of a tax audit, it is essential to be prepared. This includes maintaining accurate records, responding promptly to audit notices, and seeking professional representation if necessary. A tax audit can be a stressful experience, but being prepared can help minimize the stress and ensure a favorable outcome.

What is the best way to manage tax liability?

+The best way to manage tax liability is to consult with a tax professional and implement a comprehensive tax plan that takes into account your unique financial situation and goals.

How can I reduce my tax liability?

+Reducing tax liability can be achieved through various strategies such as tax-deferred savings, tax-loss harvesting, and bunching deductions. It is essential to consult with a tax professional to determine the best strategies for your specific situation.

In conclusion, managing tax liability requires a comprehensive approach that includes understanding tax laws and regulations, implementing tax planning strategies, and being prepared for tax audits. By following these tips and consulting with a tax professional, you can minimize stress and ensure compliance with tax laws.