How To File Allstate Life Claim? Easy Steps

Filing a life insurance claim with Allstate can be a straightforward process if you have the necessary documents and follow the steps outlined below. It's essential to understand the process to ensure that your claim is handled efficiently and that you receive the benefits you're entitled to. Allstate is one of the largest insurance companies in the United States, offering a range of insurance products, including life insurance. Their life insurance policies are designed to provide financial protection for your loved ones in the event of your passing.

Understanding the Claim Process

Before you start the claim process, it’s crucial to understand the basics of how Allstate handles life insurance claims. The process typically begins with notifying Allstate of the policyholder’s passing. This can be done over the phone, online, or through the mail. You will need to provide certain documents, including the policy number, a copy of the death certificate, and possibly other identification documents. The claim process can vary slightly depending on the type of life insurance policy you have, such as term life, whole life, or universal life, so it’s a good idea to review your policy documents or speak with an Allstate representative for specific guidance.

Gathering Necessary Documents

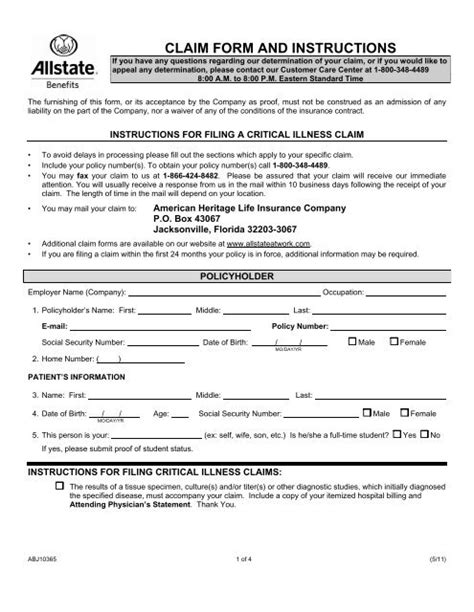

To file a claim, you’ll need to gather several documents. These may include: - Death certificate: An official copy of the death certificate is usually required. This document is essential for verifying the policyholder’s passing. - Policy documents: You’ll need the actual life insurance policy or the policy number to initiate the claim. - Identification: You may need to provide identification, such as a driver’s license or passport, to verify your relationship to the policyholder. - Claim form: Allstate will provide a claim form that you’ll need to complete. This form will ask for details about the policyholder and the claim.

| Document | Description |

|---|---|

| Death Certificate | An official document verifying the policyholder's passing |

| Policy Number | Unique identifier for the life insurance policy |

| Identification | Driver's license, passport, etc., for verification purposes |

| Claim Form | Document provided by Allstate to initiate the claim process |

Step-by-Step Guide to Filing a Claim

Filing a claim with Allstate involves several steps: 1. Notify Allstate: The first step is to inform Allstate about the policyholder’s passing. You can do this by calling their customer service number, visiting their website, or mailing a notification letter. 2. Gather Documents: Collect all the necessary documents as outlined above. 3. Complete Claim Form: Fill out the claim form provided by Allstate. Ensure all information is accurate and complete to avoid delays in processing your claim. 4. Submit Claim: Once you have all the documents and the completed claim form, submit them to Allstate. You can usually do this by mail or through their website, depending on the options available for your policy. 5. Follow Up: After submitting your claim, it’s a good idea to follow up with Allstate to ensure they have received all the necessary documents and to inquire about the status of your claim.

What to Expect After Submitting Your Claim

After Allstate receives your claim, they will review it to ensure all necessary documentation is included and that the policy is in good standing. This process can take several weeks, depending on the complexity of the claim and how quickly Allstate can verify the information provided. Once your claim is approved, the benefits will be paid out according to the terms of the policy. It’s essential to review your policy documents or speak with an Allstate representative to understand how benefits are distributed and any tax implications.

How long does it take for Allstate to process a life insurance claim?

+The processing time can vary but typically takes several weeks. The exact timeframe depends on the complexity of the claim and the speed at which Allstate can verify the information provided.

What happens if I'm missing some of the required documents for the claim?

+If you're missing documents, Allstate will notify you of what's needed to complete the claim. You can then provide the missing information, and the claim process will continue once all necessary documents are received.

In conclusion, filing a life insurance claim with Allstate requires careful attention to detail and adherence to their claim process. By understanding what documents are needed, how to submit a claim, and what to expect during the process, you can navigate this challenging time more efficiently. Remember, it’s crucial to review your policy and understand its terms and conditions to ensure you’re taking the correct steps. If you have any questions or concerns, don’t hesitate to reach out to Allstate for guidance and support.