Epli Benefits: Reduce Workplace Risks

Employment Practices Liability Insurance (EPLI) is a type of insurance that protects employers against claims made by employees, former employees, or job applicants. The primary purpose of EPLI is to provide financial protection against lawsuits and other claims that may arise from employment-related practices. In this article, we will discuss the benefits of EPLI in reducing workplace risks and provide specific examples of how it can help employers mitigate potential liabilities.

Understanding EPLI Benefits

EPLI benefits can be broadly categorized into two main areas: financial protection and risk management. Financial protection refers to the insurance coverage provided by EPLI policies, which can help employers pay for legal fees, settlements, and judgments arising from employment-related claims. Risk management, on the other hand, refers to the proactive measures that employers can take to reduce the likelihood of such claims occurring in the first place. Effective risk management strategies can help employers minimize the risk of employment-related claims and reduce the overall cost of EPLI premiums.

EPLI Coverage and Benefits

EPLI policies typically provide coverage for a range of employment-related claims, including discrimination, harassment, retaliation, and wrongful termination. The specific benefits of EPLI coverage can vary depending on the policy and the insurer, but may include:

- Coverage for legal fees and expenses associated with defending against employment-related claims

- Coverage for settlements and judgments arising from employment-related claims

- Coverage for punitive damages and other non-compensatory damages

- Access to risk management resources and tools to help employers reduce the likelihood of employment-related claims

In addition to these benefits, EPLI policies may also provide coverage for third-party claims, such as claims made by customers, vendors, or other business partners. This can be particularly important for employers who interact with third parties on a regular basis.

| Type of Claim | EPLI Coverage |

|---|---|

| Discrimination | Coverage for legal fees and expenses, settlements, and judgments |

| Harassment | Coverage for legal fees and expenses, settlements, and judgments |

| Retaliation | Coverage for legal fees and expenses, settlements, and judgments |

| Wrongful Termination | Coverage for legal fees and expenses, settlements, and judgments |

Reducing Workplace Risks with EPLI

In addition to providing financial protection against employment-related claims, EPLI can also help employers reduce workplace risks by promoting best practices in employment law compliance. By providing access to risk management resources and tools, EPLI policies can help employers identify and mitigate potential risks before they become major liabilities. This can include training programs for managers and employees, policy development and review, and investigations into allegations of misconduct.

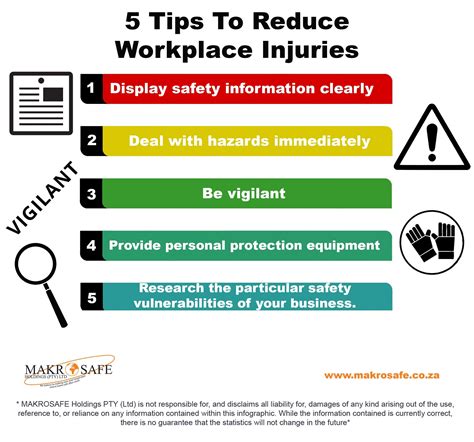

Best Practices for EPLI Risk Management

Employers who want to reduce workplace risks and minimize the likelihood of employment-related claims should consider implementing the following best practices:

- Develop and implement clear, concise policies and procedures for employment-related issues

- Provide regular training and education for managers and employees on employment law compliance and best practices

- Conduct regular investigations into allegations of misconduct and take prompt, effective action to address any issues that are identified

- Review and update employment policies and procedures regularly to ensure that they are compliant with changing laws and regulations

By implementing these best practices, employers can reduce the likelihood of employment-related claims and minimize the overall cost of EPLI premiums. Regular review and updating of policies and procedures is particularly important, as it can help employers stay ahead of changing laws and regulations and reduce the risk of non-compliance.

What is the primary purpose of EPLI coverage?

+The primary purpose of EPLI coverage is to provide financial protection against lawsuits and other claims that may arise from employment-related practices. This can include coverage for legal fees and expenses, settlements, and judgments arising from employment-related claims.

What types of claims are typically covered by EPLI policies?

+EPLI policies typically provide coverage for a range of employment-related claims, including discrimination, harassment, retaliation, and wrongful termination. The specific benefits of EPLI coverage can vary depending on the policy and the insurer.

How can employers reduce workplace risks and minimize the likelihood of employment-related claims?

+Employers can reduce workplace risks and minimize the likelihood of employment-related claims by implementing best practices in employment law compliance. This can include developing and implementing clear, concise policies and procedures, providing regular training and education for managers and employees, and conducting regular investigations into allegations of misconduct.