Directors Insurance

Directors insurance, also known as directors and officers (D&O) insurance, is a type of liability insurance that protects the personal assets of corporate directors and officers from lawsuits and other claims. This type of insurance is essential for companies, as it helps to attract and retain top talent by providing a financial safety net for executives who make important decisions on behalf of the organization. In the event of a lawsuit or claim, directors insurance can help to cover the costs of legal defense, settlements, and judgments, thereby protecting the personal assets of the directors and officers.

Types of Directors Insurance

There are several types of directors insurance policies available, each providing different levels of coverage and protection. The most common types of directors insurance include:

- Side A coverage: This type of coverage protects the personal assets of directors and officers from lawsuits and claims, and is typically purchased by the company to protect its executives.

- Side B coverage: This type of coverage reimburses the company for the costs of defending its directors and officers against lawsuits and claims, and is often included as part of a broader D&O insurance policy.

- Side C coverage: This type of coverage, also known as entity coverage, protects the company itself from lawsuits and claims, and is often included as part of a broader D&O insurance policy.

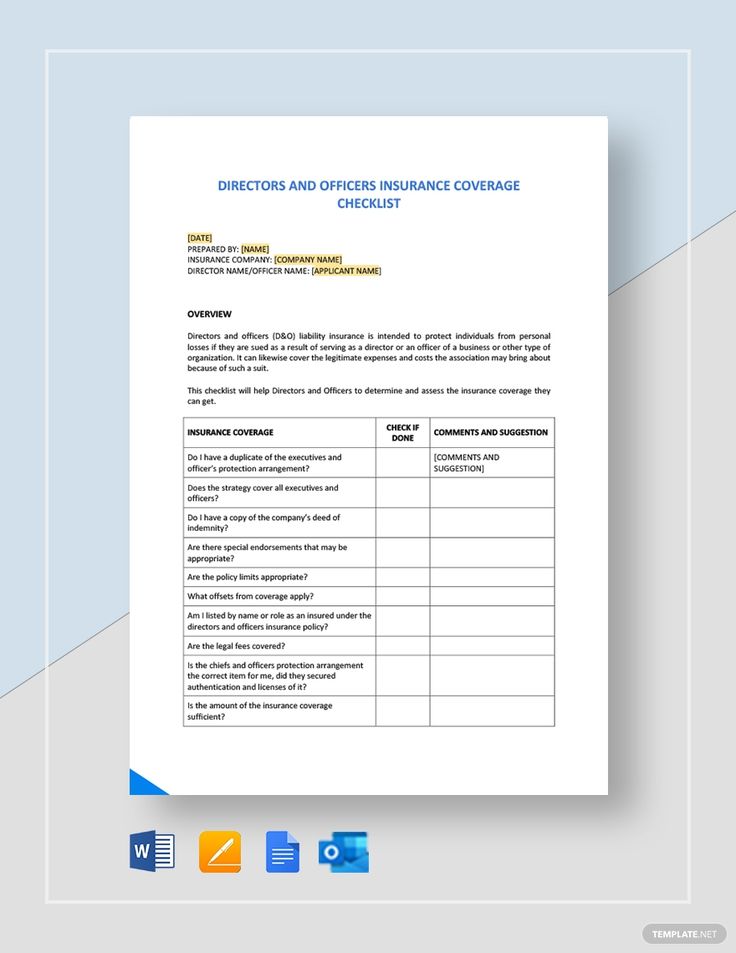

Key Features of Directors Insurance

Directors insurance policies typically include several key features, such as:

Policy limits: The maximum amount of coverage provided by the policy, which can range from a few hundred thousand dollars to several million dollars.

Deductible: The amount that the company or its directors and officers must pay out of pocket before the insurance coverage kicks in.

Retention: The amount that the company or its directors and officers must pay towards the costs of defense and settlement, before the insurance coverage kicks in.

Exclusions: Certain types of claims or lawsuits that are not covered by the policy, such as claims related to fraud or intentional misconduct.

| Policy Feature | Description |

|---|---|

| Policy Limits | The maximum amount of coverage provided by the policy |

| Deductible | The amount that the company or its directors and officers must pay out of pocket before the insurance coverage kicks in |

| Retention | The amount that the company or its directors and officers must pay towards the costs of defense and settlement, before the insurance coverage kicks in |

Benefits of Directors Insurance

Directors insurance provides several benefits to companies and their executives, including:

Protection of personal assets: Directors insurance helps to protect the personal assets of directors and officers from lawsuits and claims, thereby providing a financial safety net.

Attracting and retaining talent: By providing a financial safety net, directors insurance can help companies to attract and retain top talent, as executives are more likely to join a company that provides adequate protection.

Reducing financial risk: Directors insurance can help to reduce the financial risk associated with lawsuits and claims, thereby providing a more stable financial environment for the company.

Common Claims Made Against Directors and Officers

Directors and officers can face a range of claims and lawsuits, including:

Securities claims: Claims related to the issuance of securities, such as allegations of misrepresentation or omission.

Employment practices claims: Claims related to employment practices, such as allegations of discrimination or wrongful termination.

Environmental claims: Claims related to environmental damage or pollution, such as allegations of negligence or non-compliance with regulations.

What is the purpose of directors insurance?

+The purpose of directors insurance is to protect the personal assets of corporate directors and officers from lawsuits and claims, and to provide a financial safety net for executives who make important decisions on behalf of the organization.

What types of claims are typically covered by directors insurance?

+Directors insurance typically covers claims related to securities, employment practices, environmental damage, and other types of lawsuits and claims that may be made against directors and officers.

In conclusion, directors insurance is a critical component of a company’s risk management strategy, providing protection for the personal assets of directors and officers from lawsuits and claims. By understanding the types of directors insurance available, the key features of these policies, and the benefits they provide, companies can make informed decisions about their insurance needs and ensure that they have adequate protection in place.