Business Insurance Quotes Advisor

As a business owner, it's crucial to protect your company from unforeseen risks and uncertainties. One of the most effective ways to achieve this is by investing in business insurance. With the numerous types of policies available, navigating the world of business insurance can be overwhelming, especially when it comes to obtaining quotes. In this article, we will delve into the realm of business insurance quotes, exploring the key factors to consider, the types of policies available, and expert tips for finding the most suitable coverage for your business.

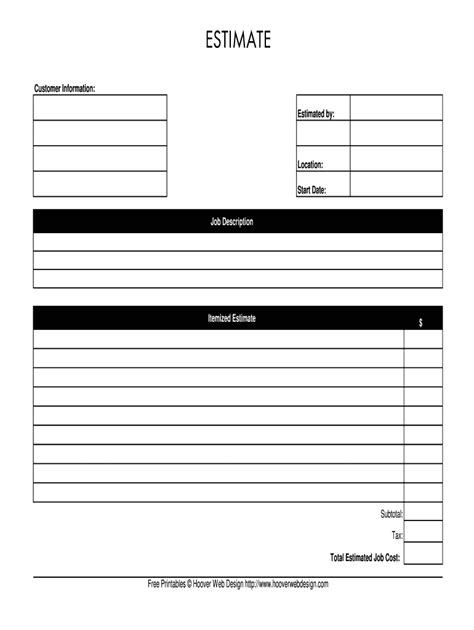

Understanding Business Insurance Quotes

Business insurance quotes are personalized estimates provided by insurance companies, outlining the terms and conditions of a potential policy. These quotes are based on various factors, including the type of business, industry, location, and level of risk. When requesting a quote, it’s essential to provide accurate and detailed information about your business to ensure that the quote accurately reflects your needs. Types of business insurance can vary significantly, ranging from general liability insurance to workers’ compensation and cyber insurance. Each type of policy is designed to address specific risks, and understanding these differences is vital for making informed decisions.

Factors Affecting Business Insurance Quotes

Several factors can influence the cost of business insurance quotes. These include industry risks, with certain sectors being deemed higher risk than others. For instance, construction companies may face higher premiums due to the physical nature of their work, whereas professional services firms might have lower rates. Business size and revenue also play a significant role, as larger businesses with higher revenues typically require more comprehensive coverage. Additionally, location can impact quotes, with businesses in areas prone to natural disasters or with high crime rates potentially facing higher premiums.

| Factor | Description |

|---|---|

| Industry Risks | Influence of industry-specific hazards on premium costs |

| Business Size and Revenue | Impact of company size and annual revenue on coverage needs and costs |

| Location | Effect of geographical location on risk assessment and premium rates |

Types of Business Insurance Policies

There are numerous types of business insurance policies designed to address various risks. General Liability Insurance provides coverage for bodily injury, property damage, and personal injury claims. Professional Liability Insurance, also known as Errors and Omissions (E&O) insurance, protects businesses against claims of professional negligence. Workers’ Compensation Insurance is mandatory in most states and covers employees’ work-related injuries and illnesses. Cyber Insurance is becoming increasingly important, as it provides protection against cyber-attacks and data breaches.

Real-World Examples

Let’s consider a few real-world scenarios to illustrate the importance of business insurance. A small retail store might opt for a Business Owner’s Policy (BOP), which combines general liability, property, and business interruption insurance. A software development company, on the other hand, might prioritize cyber insurance to protect against data breaches and intellectual property theft. A construction firm, due to the high-risk nature of their work, might need to invest in a comprehensive policy that includes workers’ compensation, general liability, and equipment insurance.

- General Liability Insurance: Protects against bodily injury, property damage, and personal injury claims

- Professional Liability Insurance: Covers claims of professional negligence

- Workers' Compensation Insurance: Mandatory in most states, covering employees' work-related injuries and illnesses

- Cyber Insurance: Provides protection against cyber-attacks and data breaches

What is the difference between general liability insurance and professional liability insurance?

+General liability insurance provides coverage for bodily injury, property damage, and personal injury claims, whereas professional liability insurance (E&O insurance) protects businesses against claims of professional negligence.

Why is cyber insurance important for my business?

+Cyber insurance is crucial as it provides protection against cyber-attacks and data breaches, which can result in significant financial losses and damage to your business reputation.

In conclusion, navigating the complex world of business insurance quotes requires a deep understanding of the factors that influence policy costs, the types of policies available, and the specific needs of your business. By considering these elements and seeking advice from insurance professionals, you can make informed decisions to protect your business from unforeseen risks and ensure its long-term success.