Aon Uk Limited: Personalised Financial Services

Aon UK Limited is a leading provider of personalised financial services, offering a wide range of solutions to individuals and businesses across the United Kingdom. With a strong presence in the UK market, Aon UK Limited has established itself as a trusted advisor, helping clients navigate the complexities of financial planning, risk management, and investment. The company's expertise spans various areas, including retirement planning, investment management, and risk assessment, ensuring that clients receive tailored guidance to achieve their financial objectives.

Personalised Financial Planning

Aon UK Limited’s personalised financial planning services are designed to address the unique needs and goals of each client. The company’s team of experienced financial advisors works closely with individuals to understand their financial situation, risk tolerance, and objectives, creating a bespoke plan that aligns with their vision. This comprehensive approach encompasses financial modelling, cash flow analysis, and tax planning, providing clients with a clear understanding of their financial position and a roadmap for achieving their goals. By leveraging Aon UK Limited’s expertise, clients can make informed decisions about their financial futures, ensuring they are well-prepared for retirement, education expenses, or other significant life events.

Investment Management

Aon UK Limited’s investment management services are built on a foundation of in-depth market research and portfolio analysis. The company’s investment experts employ a disciplined approach to portfolio construction, selecting a diversified range of assets that align with each client’s risk profile and investment objectives. This may include equities, bonds, property, and alternative investments, carefully managed to optimise returns while minimising risk. Aon UK Limited’s investment management solutions are designed to be flexible, allowing clients to adapt their portfolios as their financial circumstances and goals evolve over time.

| Investment Strategy | Typical Asset Allocation |

|---|---|

| Conservative | 40% Equities, 30% Bonds, 30% Cash |

| Balanced | 60% Equities, 20% Bonds, 20% Cash |

| Agressive | 80% Equities, 10% Bonds, 10% Cash |

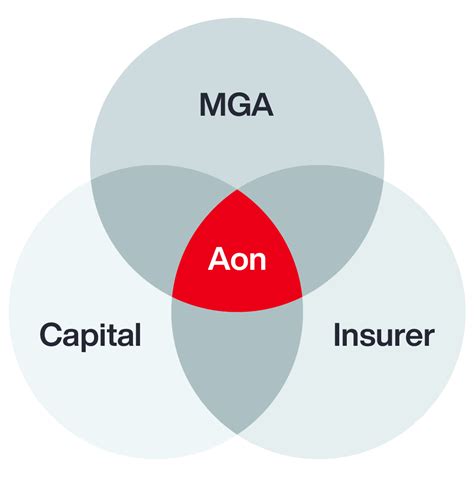

Risk Management and Insurance

Aon UK Limited’s risk management and insurance services are designed to protect clients from unforeseen events that could impact their financial well-being. The company’s team of risk specialists works with individuals and businesses to identify potential risks, assess their likelihood and impact, and develop strategies to mitigate or transfer these risks. This may involve insurance solutions, such as life insurance, income protection, and critical illness cover, as well as business protection measures, including key person insurance and shareholder protection. By addressing these risks, clients can ensure they are adequately protected against unexpected events, providing peace of mind and financial security.

Retirement Planning

Aon UK Limited’s retirement planning services are focused on helping individuals achieve their retirement goals, whether that involves maintaining their current lifestyle, pursuing new hobbies, or traveling. The company’s financial advisors work with clients to create a comprehensive retirement plan, taking into account their pension provisions, savings, and other sources of income. This may involve pension planning, annuity purchase, and drawdown strategies, as well as tax planning and estate planning to optimise their financial position in retirement. By planning carefully, clients can ensure they have sufficient income to enjoy their retirement, without worrying about financial insecurity.

| Retirement Income Source | Typical Contribution |

|---|---|

| State Pension | £8,000 - £10,000 per annum |

| Personal Pension | £10,000 - £20,000 per annum |

| Other Savings | £5,000 - £10,000 per annum |

What is the benefit of working with a financial advisor from Aon UK Limited?

+Working with a financial advisor from Aon UK Limited provides clients with access to expert guidance, tailored to their unique financial circumstances and goals. The company's advisors can help clients create a comprehensive financial plan, addressing areas such as retirement planning, investment management, and risk management, to ensure they achieve their objectives while managing risk.

How do I get started with Aon UK Limited's personalised financial services?

+To get started with Aon UK Limited's personalised financial services, clients can contact the company directly to arrange a consultation with a financial advisor. During this meeting, the advisor will discuss the client's financial goals, risk tolerance, and current circumstances, before creating a tailored plan to address their needs. This plan may involve a range of services, including investment management, retirement planning, and risk management, all designed to help the client achieve their financial objectives.

In conclusion, Aon UK Limited’s personalised financial services are designed to provide individuals and businesses with tailored guidance and support, helping them navigate the complexities of financial planning, risk management, and investment. By leveraging the company’s expertise and working closely with a financial advisor, clients can create a comprehensive financial plan that addresses their unique needs and goals, ensuring they achieve their objectives while managing risk. Whether the focus is on retirement planning, investment management, or risk assessment, Aon UK Limited is committed to delivering exceptional service and support, helping clients secure their financial futures.