Aon S.p.a. Insurance: Claims Process

Aon S.p.a. is a leading insurance company that provides a wide range of insurance products to individuals and businesses. The company has a strong presence in the global market, with operations in over 120 countries. One of the key aspects of Aon S.p.a.'s insurance services is its claims process, which is designed to provide policyholders with a smooth and efficient experience in the event of a claim. In this article, we will delve into the details of Aon S.p.a.'s claims process, including the steps involved, the required documentation, and the company's commitment to customer satisfaction.

Overview of the Claims Process

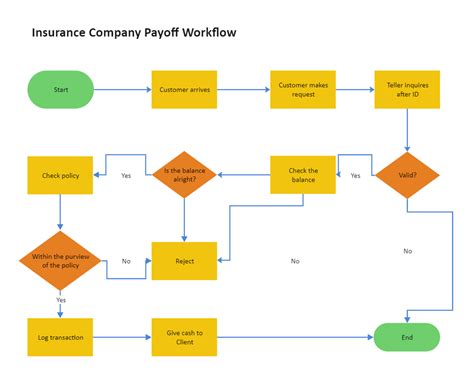

Aon S.p.a.’s claims process is designed to be straightforward and easy to navigate. The company has a dedicated claims team that works closely with policyholders to ensure that their claims are handled promptly and efficiently. The claims process typically involves the following steps: notification of the claim, assessment of the claim, investigation and evaluation, and settlement of the claim. Policyholders can notify Aon S.p.a. of a claim by contacting the company’s claims department directly, either by phone or email.

Required Documentation

To process a claim, Aon S.p.a. requires policyholders to provide certain documentation, including: proof of loss or damage, police reports (if applicable), and medical reports (if applicable). The company may also require additional documentation, such as photographs of the damage or witness statements. Policyholders should ensure that they have all the necessary documentation before submitting a claim, as this can help to speed up the claims process.

| Document Type | Description |

|---|---|

| Proof of Loss or Damage | Documentation that provides evidence of the loss or damage, such as a receipt or invoice |

| Police Report | A report from the police department, if the loss or damage was the result of a crime |

| Medical Report | A report from a medical professional, if the loss or damage resulted in injury or illness |

Claims Handling Process

Aon S.p.a.’s claims handling process is designed to be transparent and efficient. The company’s claims team works closely with policyholders to ensure that their claims are handled promptly and efficiently. The claims handling process typically involves the following steps: acknowledgement of the claim, investigation and evaluation, assessment of the claim, and settlement of the claim. Aon S.p.a. also provides policyholders with regular updates on the status of their claim, to ensure that they are informed throughout the process.

Investigation and Evaluation

Aon S.p.a.’s claims team conducts a thorough investigation and evaluation of each claim, to ensure that the claim is valid and that the policyholder is entitled to compensation. The company’s investigators may conduct interviews with witnesses, review medical reports, and inspect damaged property, to gather evidence and determine the cause of the loss or damage. The investigation and evaluation process can take several weeks or even months, depending on the complexity of the claim.

- Aon S.p.a.'s claims team conducts a thorough investigation and evaluation of each claim

- The company's investigators may conduct interviews with witnesses, review medical reports, and inspect damaged property

- The investigation and evaluation process can take several weeks or even months, depending on the complexity of the claim

How do I notify Aon S.p.a. of a claim?

+Policyholders can notify Aon S.p.a. of a claim by contacting the company's claims department directly, either by phone or email. The company's claims team is available 24/7 to handle claims notifications.

What documentation do I need to provide to support my claim?

+Aon S.p.a. requires policyholders to provide certain documentation, including proof of loss or damage, police reports (if applicable), and medical reports (if applicable). The company may also require additional documentation, such as photographs of the damage or witness statements.

How long does the claims process typically take?

+The length of time it takes to process a claim can vary, depending on the complexity of the claim and the amount of documentation required. Aon S.p.a.'s claims team works closely with policyholders to ensure that their claims are handled promptly and efficiently, and provides regular updates on the status of the claim.

Aon S.p.a.’s commitment to customer satisfaction is evident in its claims process, which is designed to provide policyholders with a smooth and efficient experience in the event of a claim. The company’s dedicated claims team works closely with policyholders to ensure that their claims are handled promptly and efficiently, and provides regular updates on the status of the claim. By providing a transparent and efficient claims process, Aon S.p.a. aims to build trust with its policyholders and provide them with peace of mind, knowing that their claims will be handled fairly and efficiently.