Aon: Insurance Market Analysis Report

The insurance market is a complex and dynamic sector that plays a vital role in the global economy. As a leading provider of risk management and insurance brokerage services, Aon has released its annual insurance market analysis report, providing an in-depth examination of the current state of the industry. The report highlights key trends, challenges, and opportunities facing insurers, reinsurers, and their clients, and offers valuable insights into the future direction of the market.

Introduction to the Insurance Market

The insurance market is a global industry that generates trillions of dollars in premiums each year. The market is characterized by a diverse range of players, including multinational insurers, regional carriers, and specialty insurers. The industry is also subject to a wide range of risks, including natural catastrophes, cyber threats, and regulatory changes. In recent years, the insurance market has undergone significant changes, driven by advances in technology, shifting consumer behaviors, and evolving regulatory requirements.

Key Trends in the Insurance Market

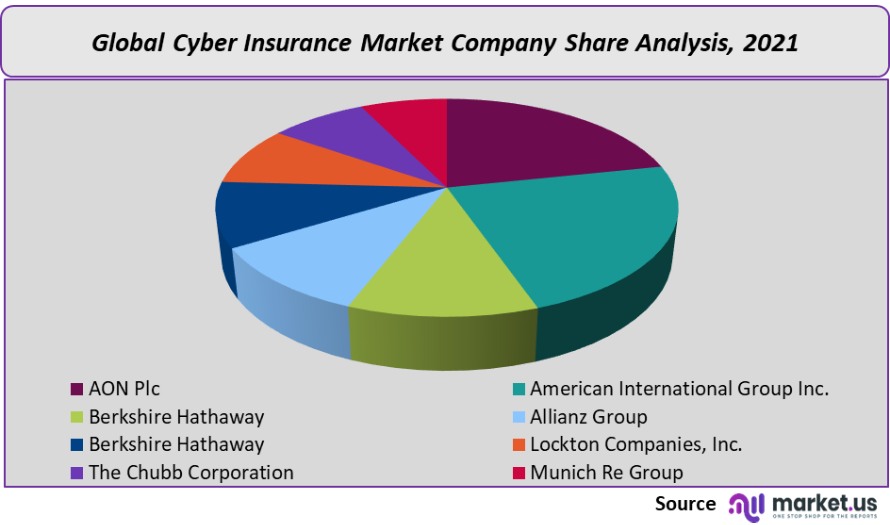

According to Aon’s report, several key trends are shaping the insurance market. These include the increasing use of artificial intelligence and machine learning to improve underwriting and claims processing, the growing demand for cyber insurance and other specialty products, and the expanding role of reinsurance in managing catastrophe risk. The report also highlights the importance of data analytics and digital transformation in driving innovation and competitiveness in the insurance industry.

| Insurance Segment | Premium Growth (2022) |

|---|---|

| Property and Casualty | 4.5% |

| Life and Health | 3.2% |

| Reinsurance | 6.1% |

The report also provides an analysis of the current market conditions, including the impact of interest rates, inflation, and regulatory changes on the insurance industry. According to Aon, the insurance market is expected to continue growing in the coming years, driven by increasing demand for insurance products and services, particularly in emerging markets.

Challenges Facing the Insurance Industry

Despite the positive outlook, the insurance industry faces several challenges, including climate change, cyber risk, and regulatory uncertainty. The report highlights the need for insurers to develop effective strategies to manage these risks, including investing in renewable energy and sustainable infrastructure, enhancing cybersecurity measures, and engaging with regulators to shape the development of new laws and regulations.

Opportunities for Growth and Innovation

The report identifies several opportunities for growth and innovation in the insurance industry, including the development of new products and services, such as parametric insurance and microinsurance, and the expansion into new markets, such as Asia and Latin America. The report also highlights the potential for insurtech and fintech to drive innovation and disruption in the insurance industry.

- Parametric insurance: a type of insurance that pays out based on predetermined parameters, such as weather events or natural disasters.

- Microinsurance: a type of insurance that provides coverage to low-income individuals and households.

- Insurtech: the use of technology to improve the efficiency and effectiveness of the insurance industry.

The report concludes by emphasizing the importance of collaboration and innovation in addressing the challenges facing the insurance industry and capitalizing on the opportunities for growth and development.

What are the key trends shaping the insurance market?

+The key trends shaping the insurance market include the increasing use of artificial intelligence and machine learning, the growing demand for cyber insurance and other specialty products, and the expanding role of reinsurance in managing catastrophe risk.

What are the challenges facing the insurance industry?

+The insurance industry faces several challenges, including climate change, cyber risk, and regulatory uncertainty. Insurers must develop effective strategies to manage these risks and capitalize on the opportunities for growth and innovation.