Actuary Career Path: Certification

The actuary career path is a highly specialized and technical field that requires a strong foundation in mathematics, statistics, and business. Actuaries use their knowledge of probability, statistics, and economics to assess and manage risk in a variety of industries, including insurance, finance, and healthcare. One of the key milestones in an actuary's career is obtaining certification, which is a critical step in demonstrating expertise and professionalism in the field. In this article, we will explore the actuary career path and the certification process in detail.

Certification Overview

Certification is a vital component of an actuary’s career, as it demonstrates a level of competence and expertise in the field. In the United States, the most common certifications for actuaries are offered by the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS). The SOA offers certifications in life and health insurance, retirement benefits, and investments, while the CAS offers certifications in property and casualty insurance. To become certified, actuaries must pass a series of exams, complete coursework, and gain practical experience in the field.

Certification Requirements

The certification requirements for actuaries vary depending on the specific certification and the organization offering it. However, most certifications require actuaries to pass a series of exams, complete coursework, and gain practical experience in the field. The SOA and CAS offer a variety of certifications, including the Fellow of the Society of Actuaries (FSA) and the Fellow of the Casualty Actuarial Society (FCAS). To become an FSA or FCAS, actuaries must pass a series of exams, complete coursework, and gain at least 3 years of practical experience in the field.

| Certification | Organization | Requirements |

|---|---|---|

| Fellow of the Society of Actuaries (FSA) | Society of Actuaries (SOA) | Pass 7-10 exams, complete coursework, and gain 3 years of practical experience |

| Fellow of the Casualty Actuarial Society (FCAS) | Casualty Actuarial Society (CAS) | Pass 7-10 exams, complete coursework, and gain 3 years of practical experience |

Exam Process

The exam process for actuaries is rigorous and challenging. Actuaries must pass a series of exams, which test their knowledge of mathematics, statistics, and business. The exams are offered by the SOA and CAS, and are typically taken over a period of several years. The exams cover a range of topics, including probability, statistics, economics, and finance. Actuaries must also complete coursework and gain practical experience in the field to demonstrate their expertise.

Exam Topics

The exam topics for actuaries vary depending on the specific certification and the organization offering it. However, most exams cover a range of topics, including:

- Probability and statistics

- Economics and finance

- Insurance and risk management

- Investments and asset management

- Pensions and retirement benefits

Actuaries must also demonstrate their knowledge of actuarial science, which includes the application of mathematical and statistical techniques to assess and manage risk. Actuaries must also be familiar with financial modeling, which involves the use of mathematical models to predict and manage financial risk.

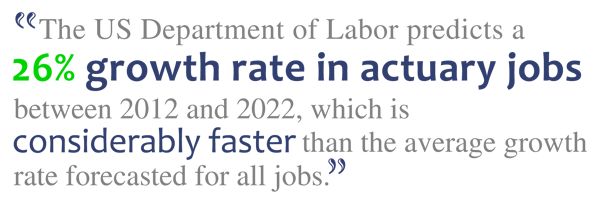

Benefits of Certification

Certification offers a range of benefits for actuaries, including increased earning potential, career advancement opportunities, and professional recognition. Certified actuaries are recognized as experts in their field, and are often sought after by employers for their expertise and knowledge. Certification also demonstrates a level of competence and professionalism, which can lead to increased job satisfaction and career fulfillment.

Salary and Benefits

Certified actuaries can expect to earn higher salaries and benefits than non-certified actuaries. According to the Bureau of Labor Statistics, the median annual salary for actuaries in the United States is around 110,000. However, certified actuaries can earn significantly more, with some earning upwards of 200,000 or more per year.

| Certification | Median Salary | Top Salary |

|---|---|---|

| Fellow of the Society of Actuaries (FSA) | $120,000 | $250,000 |

| Fellow of the Casualty Actuarial Society (FCAS) | $130,000 | $300,000 |

What is the difference between the FSA and FCAS certifications?

+The FSA and FCAS certifications are both offered by the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS), respectively. The main difference between the two certifications is the focus area. The FSA certification focuses on life and health insurance, retirement benefits, and investments, while the FCAS certification focuses on property and casualty insurance.

How long does it take to become certified?

+The time it takes to become certified can vary depending on the individual and the certification. However, most actuaries can expect to spend several years studying and preparing for the exams. It's also important to gain practical experience in the field to demonstrate expertise and build a strong foundation for a successful career.

In conclusion, the actuary career path is a highly specialized and technical field that requires a strong foundation in mathematics, statistics, and business. Certification is a critical step in demonstrating expertise and professionalism in the field, and offers a range of benefits, including increased earning potential, career advancement opportunities, and professional recognition. Actuaries should be prepared to spend several years studying and preparing for the exams, and gaining practical experience in the field to build a strong foundation for a successful career.