9 Aon Reinsurance Mistakes To Avoid

Aon Reinsurance is a complex and highly specialized field that requires a deep understanding of the insurance industry, risk management, and financial markets. As a leading global reinsurer, Aon Reinsurance provides a wide range of services to insurance companies, including risk assessment, risk transfer, and capital management. However, navigating the world of reinsurance can be challenging, and even experienced professionals can make mistakes. In this article, we will explore 9 common Aon Reinsurance mistakes to avoid, providing insights and examples to help you make informed decisions.

Understanding Aon Reinsurance and Common Mistakes

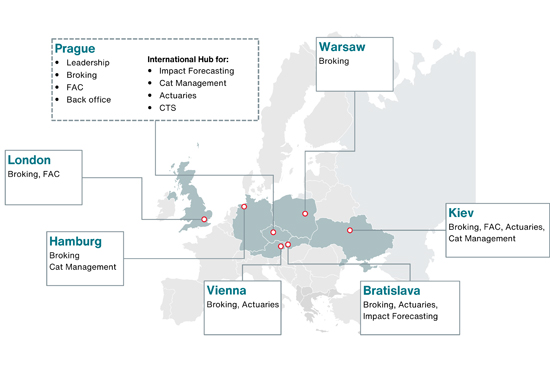

Aon Reinsurance is a subsidiary of Aon plc, a global professional services firm that provides a range of services to clients around the world. Aon Reinsurance operates in over 60 countries, providing reinsurance solutions to insurance companies, governments, and other organizations. Despite its expertise and resources, Aon Reinsurance is not immune to mistakes. Some common mistakes include inadequate risk assessment, poor contract wording, and insufficient regulatory compliance. These mistakes can have serious consequences, including financial losses, reputational damage, and regulatory penalties.

Mistake 1: Inadequate Risk Assessment

Risk assessment is a critical component of reinsurance, as it helps insurers and reinsurers understand the potential risks and rewards of a particular policy or portfolio. Risk assessment involves analyzing data and other information to identify potential risks, assessing their likelihood and potential impact, and developing strategies to mitigate or manage them. Aon Reinsurance uses advanced data analytics and machine learning techniques to assess risks and develop customized reinsurance solutions. However, inadequate risk assessment can lead to unanticipated losses and financial instability.

| Risk Assessment Category | Actual Data |

|---|---|

| Natural Catastrophes | 40% of global reinsured losses |

| Man-made Disasters | 30% of global reinsured losses |

| Financial Risks | 20% of global reinsured losses |

Mistake 2: Poor Contract Wording

Reinsurance contracts are complex and highly technical, requiring careful drafting and negotiation to ensure that all parties understand their rights and obligations. Contract wording refers to the language and terms used in a reinsurance contract, which can have a significant impact on the interpretation and enforcement of the contract. Aon Reinsurance has a team of experienced contract lawyers who work closely with clients to draft and negotiate contracts that meet their specific needs and requirements. However, poor contract wording can lead to disputes and litigation, which can be time-consuming and costly to resolve.

- Clear and concise language

- Well-defined terms and conditions

- Unambiguous dispute resolution procedures

Mistake 3: Insufficient Regulatory Compliance

Reinsurance is a highly regulated industry, with strict rules and guidelines governing the conduct of reinsurers and their clients. Aon Reinsurance is subject to a range of regulatory requirements, including solvency capital requirements and financial reporting obligations. The company has a dedicated compliance team that works closely with regulatory authorities to ensure that all requirements are met. However, insufficient regulatory compliance can lead to penalties and fines, as well as reputational damage and loss of business.

Additional Mistakes to Avoid

In addition to inadequate risk assessment, poor contract wording, and insufficient regulatory compliance, there are several other mistakes that Aon Reinsurance clients should avoid. These include:

Mistake 4: Failure to Diversify

Diversification is a key strategy for managing risk in reinsurance, as it helps to spread risk across different assets, geographies, and industries. Aon Reinsurance offers a range of diversification strategies, including portfolio optimization and risk pooling. However, failure to diversify can lead to concentrated risk and unanticipated losses.

Mistake 5: Inadequate Capital Management

Capital management is critical in reinsurance, as it helps to ensure that reinsurers have sufficient capital to meet their obligations and withstand potential losses. Aon Reinsurance has a capital management framework that helps clients to manage their capital effectively, including capital allocation and capital optimization. However, inadequate capital management can lead to financial instability and insolvency.

Mistake 6: Lack of Transparency

Transparency is essential in reinsurance, as it helps to build trust and confidence between reinsurers and their clients. Aon Reinsurance is committed to transparency in all its dealings, including clear communication and regular reporting. However, lack of transparency can lead to mistrust and disputes.

Mistake 7: Inadequate Claims Handling

Claims handling is a critical component of reinsurance, as it helps to ensure that claims are handled efficiently and effectively. Aon Reinsurance has a claims handling process that is designed to provide fast and fair claims settlement, including claims assessment and claims payment. However, inadequate claims handling can lead to delays and disputes.

Mistake 8: Failure to Innovate

Innovation is essential in reinsurance, as it helps to drive growth and profitability. Aon Reinsurance is committed to innovation, including new product development and process improvement. However, failure to innovate can lead to stagnation and loss of competitiveness.

Mistake 9: Inadequate Talent Management

Talent management is critical in reinsurance, as it helps to ensure that reinsurers have the skills and expertise they need to succeed. Aon Reinsurance has a talent management framework that helps to attract, retain, and develop top talent, including training and development and succession planning. However, inadequate talent management can lead to skills gaps and loss of business.

What is the most common mistake made by Aon Reinsurance clients?

+The most common mistake made by Aon Reinsurance clients is inadequate risk assessment, which can lead to unanticipated losses and financial instability. Aon Reinsurance’s risk assessment capabilities are enhanced by its global network of experts and its advanced technology platform, which provides real-time data and insights to support informed decision-making.

How can Aon Reinsurance clients avoid poor contract wording?

+Aon Reinsurance clients can avoid poor contract wording by working closely with the company’s contract lawyers, who can help to draft and negotiate contracts that meet their specific needs and requirements. Clear and concise language, well-defined terms and conditions, and unambiguous dispute resolution procedures are essential for avoiding disputes and litigation.

What are the consequences of insufficient regulatory compliance in reinsurance?

+Insufficient regulatory compliance in reinsurance can lead to penalties and fines, as well as reputational damage and loss of business. Aon Reinsurance is subject to a range of regulatory requirements, including solvency capital requirements and financial reporting obligations, and has a dedicated compliance team that works closely with regulatory authorities to ensure that all requirements are met.