8 Aon Central Risk Services To Optimize

Aon Central Risk Services offers a comprehensive range of solutions designed to help organizations optimize their risk management strategies. With a focus on delivering tailored advice and support, Aon's expert team works closely with clients to identify, assess, and mitigate potential risks that could impact their business. In this article, we will explore eight key services provided by Aon Central Risk Services to optimize risk management.

Introduction to Aon Central Risk Services

Aon Central Risk Services is a leading provider of risk management solutions, offering a broad spectrum of services to help organizations navigate the complex and ever-evolving risk landscape. By leveraging Aon’s extensive expertise and resources, businesses can gain a deeper understanding of their risk profile and develop effective strategies to minimize potential losses. The eight key services offered by Aon Central Risk Services to optimize risk management include:

Risk Assessment and Analysis

Aon’s risk assessment and analysis service provides organizations with a comprehensive review of their risk profile, identifying potential vulnerabilities and areas for improvement. This service involves a thorough examination of the organization’s operations, including its people, processes, and technology, to pinpoint potential risks and develop targeted mitigation strategies. By utilizing risk modeling techniques, Aon’s experts can help businesses quantify their risk exposure and prioritize mitigation efforts.

| Risk Assessment Category | Description |

|---|---|

| Operational Risk | Assesses the risk of loss resulting from inadequate or failed internal processes, systems, and people |

| Financial Risk | Evaluates the risk of financial loss due to market fluctuations, credit risks, and other financial factors |

| Compliance Risk | Examines the risk of non-compliance with regulatory requirements and industry standards |

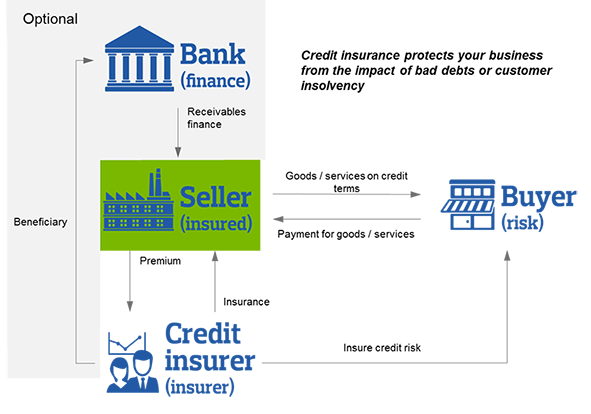

Risk Mitigation and Transfer

Once potential risks have been identified, Aon’s risk mitigation and transfer service helps organizations develop strategies to minimize or transfer these risks. This may involve implementing risk-reducing measures, such as process improvements or staff training, or transferring risks to third-party providers through insurance contracts or other risk transfer mechanisms. By leveraging Aon’s extensive network of insurance carriers and risk transfer providers, businesses can access a broad range of risk mitigation and transfer solutions.

Risk Financing and Insurance

Aon’s risk financing and insurance service provides organizations with access to a wide range of insurance products and risk financing solutions. By working closely with Aon’s expert team, businesses can develop a tailored insurance program that addresses their specific risk profile and financial objectives. This service includes:

- Insurance policy design and placement

- Risk financing strategy development

- Insurance program management and administration

Claims Management and Recovery

In the event of a loss, Aon’s claims management and recovery service provides organizations with expert support and guidance to help them navigate the claims process and maximize their recovery. This service includes:

- Claims notification and reporting

- Claims investigation and analysis

- Claims settlement negotiation and recovery

Compliance and Regulatory Risk Management

Aon’s compliance and regulatory risk management service helps organizations navigate the complex and ever-evolving regulatory landscape, ensuring compliance with relevant laws, regulations, and industry standards. This service includes:

A comprehensive review of the organization's compliance framework, identification of potential compliance risks, and development of targeted mitigation strategies. By leveraging Aon's extensive expertise in compliance and regulatory risk management, businesses can minimize the risk of non-compliance and associated penalties.

Cyber Risk Management

Aon’s cyber risk management service helps organizations assess and mitigate the risks associated with cyber threats, including data breaches, hacking, and other cyber-attacks. This service includes:

A comprehensive review of the organization's cyber risk profile, identification of potential vulnerabilities, and development of targeted mitigation strategies. By leveraging Aon's extensive expertise in cyber risk management, businesses can minimize the risk of cyber-attacks and associated losses.

Supply Chain Risk Management

Aon’s supply chain risk management service helps organizations assess and mitigate the risks associated with their supply chain, including supplier insolvency, logistics disruptions, and other supply chain-related risks. This service includes:

A comprehensive review of the organization's supply chain risk profile, identification of potential vulnerabilities, and development of targeted mitigation strategies. By leveraging Aon's extensive expertise in supply chain risk management, businesses can minimize the risk of supply chain disruptions and associated losses.

What is the purpose of Aon Central Risk Services?

+Aon Central Risk Services is designed to help organizations optimize their risk management strategies, providing a comprehensive range of solutions to identify, assess, and mitigate potential risks.

What services are offered by Aon Central Risk Services?

+Aon Central Risk Services offers a range of services, including risk assessment and analysis, risk mitigation and transfer, risk financing and insurance, claims management and recovery, compliance and regulatory risk management, cyber risk management, and supply chain risk management.

In conclusion, Aon Central Risk Services provides organizations with a comprehensive range of solutions to optimize their risk management strategies. By leveraging Aon’s extensive expertise and resources, businesses can gain a deeper understanding of their risk profile and develop effective strategies to minimize potential losses. The eight key services offered by Aon Central Risk Services, including risk assessment and analysis, risk mitigation and transfer, risk financing and insurance, claims management and recovery, compliance and regulatory risk management, cyber risk management, and supply chain risk management, provide a tailored approach to managing risks and minimizing potential losses.