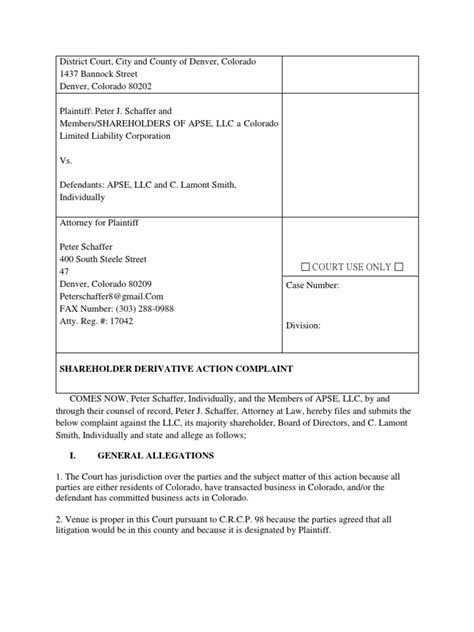

7 Derivative Action Courtroom Secrets

The derivative action is a legal proceeding that allows shareholders to bring a lawsuit on behalf of the corporation when the company itself fails to take action against wrongdoing or breaches of duty by its directors, officers, or other insiders. This type of lawsuit is crucial for holding corporate leaders accountable and protecting the interests of shareholders. However, navigating the complexities of derivative action litigation can be daunting, even for seasoned legal professionals. In this article, we will delve into the courtroom secrets of derivative actions, exploring the key strategies, tactics, and considerations that can make or break a case.

Understanding Derivative Actions: A Primer

Derivative actions are brought by shareholders in the name of the corporation to remedy injuries to the corporation itself. These actions are distinct from direct actions, which are brought by shareholders to address personal injuries or claims. The fiduciary duty owed by corporate directors and officers to the corporation and its shareholders is a central concept in derivative actions. When this duty is breached, shareholders may seek redress through the courts. Pre-suit demands and demand futility are critical components of derivative action litigation, as they involve the process of requesting that the corporation take action against the wrongdoing before a lawsuit is filed.

Pre-Suit Demands: Strategy and Considerations

Before filing a derivative lawsuit, shareholders typically must make a demand on the corporation’s board of directors to take action against the alleged wrongdoing. This demand is an essential step, as it allows the board to investigate the claims and decide whether to pursue litigation. However, demand futility may exist if the board is incapable of making an impartial decision due to conflicts of interest or other factors. In such cases, shareholders may proceed with filing a derivative action without first making a demand. Understanding the nuances of pre-suit demands and demand futility is crucial for successfully navigating the early stages of derivative action litigation.

| Category | Description |

|---|---|

| Pre-Suit Demand | A formal request by shareholders for the corporation to take action against alleged wrongdoing. |

| Demand Futility | A condition where making a demand would be futile due to the board's inability to act impartially. |

| Fiduciary Duty | The legal obligation of corporate directors and officers to act in the best interests of the corporation and its shareholders. |

Courtroom Strategies and Tactics

Once a derivative action is filed, the courtroom strategy becomes paramount. Shareholders must demonstrate that the corporation suffered an injury and that the defendants’ actions (or inactions) caused this harm. Expert testimony can play a significant role in establishing the extent of the injury and the causal link between the defendants’ conduct and the harm suffered. Additionally, documentary evidence, including corporate records, emails, and other communications, can provide critical insights into the decision-making processes and motivations of the defendants.

Discovery and Evidence

The discovery phase of derivative action litigation is where the majority of the evidence is gathered. This process involves depositions, interrogatories, and the exchange of document production. Effective management of the discovery process is essential for uncovering key evidence that can support or defend against the claims made. The admissibility and relevance of evidence are determined by the court, making the presentation of evidence a strategic aspect of the litigation. Understanding the rules of evidence and how to authenticate documents and qualify expert witnesses is vital for building a strong case.

- Depositions: Sworn testimony of witnesses taken outside of court.

- Interrogatories: Written questions posed to parties involved in the lawsuit.

- Document Production: The process of exchanging documents relevant to the case between parties.

What is the primary purpose of a derivative action lawsuit?

+The primary purpose of a derivative action lawsuit is to allow shareholders to bring a claim on behalf of the corporation when the corporation itself fails to act against wrongdoing or breaches of duty by its directors, officers, or other insiders.

How does demand futility impact the filing of a derivative action?

+Demand futility allows shareholders to proceed with filing a derivative action without first making a demand on the corporation's board of directors if the board is incapable of making an impartial decision due to conflicts of interest or other factors.

In conclusion, derivative action litigation is a complex and nuanced area of law that requires a deep understanding of corporate governance, fiduciary duties, and legal procedure. By grasping the courtroom secrets and strategies outlined above, shareholders and their legal representatives can better navigate the challenges of derivative action lawsuits, ultimately working towards justice and accountability within the corporate world.