7 Aon Risk Audit Procedures To Follow

Aon risk audit procedures are designed to help organizations identify, assess, and mitigate potential risks that could impact their operations, finances, and reputation. As a leading global professional services firm, Aon provides a range of risk management solutions to help businesses navigate complex and evolving risk landscapes. In this article, we will outline 7 Aon risk audit procedures to follow, providing a comprehensive framework for organizations to manage risk and achieve their objectives.

Introduction to Aon Risk Audit Procedures

Aon risk audit procedures are based on a robust and structured approach to risk management, which involves identifying, assessing, prioritizing, and mitigating risks. The procedures are designed to be flexible and adaptable, allowing organizations to tailor their risk management approach to their specific needs and circumstances. The 7 Aon risk audit procedures outlined in this article provide a comprehensive framework for managing risk, covering risk identification, risk assessment, risk prioritization, risk mitigation, risk monitoring, risk reporting, and risk review.

Risk Identification

The first step in the Aon risk audit procedure is to identify potential risks that could impact the organization. This involves reviewing internal and external factors, such as market trends, regulatory requirements, and operational processes, to identify potential risks. Risk identification is a critical step in the risk management process, as it provides the foundation for subsequent risk assessment and mitigation activities. Organizations can use a range of techniques to identify risks, including sampling, surveys, and focus groups.

| Risk Category | Risk Description |

|---|---|

| Strategic Risk | Risks related to the organization's strategy and objectives |

| Operational Risk | Risks related to the organization's operations and processes |

| Financial Risk | Risks related to the organization's financial management and performance |

Risk Assessment

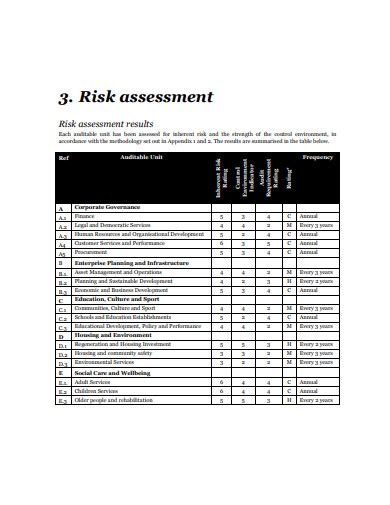

Once potential risks have been identified, the next step is to assess their likelihood and impact. Risk assessment involves evaluating the potential consequences of each risk, including the likelihood of occurrence and the potential impact on the organization. Organizations can use a range of techniques to assess risks, including probability-impact matrices and sensitivity analysis. The results of the risk assessment will inform the development of risk mitigation strategies and prioritize risk management activities.

Risk Prioritization and Mitigation

After assessing the risks, the next step is to prioritize them based on their likelihood and impact. Risk prioritization involves ranking risks in order of their potential impact on the organization, allowing risk management activities to be focused on the most critical risks. Organizations can use a range of techniques to prioritize risks, including cost-benefit analysis and decision trees. Once risks have been prioritized, the next step is to develop and implement risk mitigation strategies. Risk mitigation involves taking actions to reduce the likelihood or impact of risks, such as implementing new processes or controls, or transferring risks to third parties.

Risk Monitoring and Reporting

Risk management is an ongoing process that requires continuous monitoring and reporting. Risk monitoring involves tracking and reviewing risks to ensure that they are being effectively managed, while risk reporting involves providing stakeholders with regular updates on risk management activities and outcomes. Organizations can use a range of tools and techniques to monitor and report on risks, including risk dashboards and key risk indicators.

| Risk Metric | Risk Threshold |

|---|---|

| Risk Score | High: 80-100, Medium: 50-79, Low: 0-49 |

| Risk Probability | High: 70-100%, Medium: 30-69%, Low: 0-29% |

Risk Review and Update

The final step in the Aon risk audit procedure is to review and update the risk management process. Risk review involves evaluating the effectiveness of risk management activities and identifying areas for improvement, while risk update involves revising the risk management process to reflect changes in the organization’s risk profile or risk management objectives. Organizations can use a range of techniques to review and update their risk management process, including lessons learned and root cause analysis.

Best Practices for Implementing Aon Risk Audit Procedures

Implementing Aon risk audit procedures requires a structured and disciplined approach to risk management. Organizations should establish a clear risk management framework, define risk management roles and responsibilities, and provide ongoing training and support to risk management personnel. Risk management governance is also critical, involving the establishment of risk management policies, procedures, and standards to ensure that risk management activities are properly governed and overseen.

What is the purpose of Aon risk audit procedures?

+The purpose of Aon risk audit procedures is to provide a comprehensive framework for managing risk, covering risk identification, risk assessment, risk prioritization, risk mitigation, risk monitoring, risk reporting, and risk review.

How often should risk management activities be reviewed and updated?

+Risk management activities should be reviewed and updated regularly, ideally on an annual basis, to ensure that they remain effective and aligned with the organization's risk management objectives.

In conclusion, Aon risk audit procedures provide a comprehensive framework for managing risk, covering risk identification, risk assessment, risk prioritization, risk mitigation, risk monitoring, risk reporting, and risk review. By following these procedures, organizations can ensure that they are properly managing risk and achieving their objectives. Remember to always involve stakeholders from across the organization in the risk management process, and to provide ongoing training and support to risk management personnel.