401K Pep

The 401(k) plan is a type of retirement savings plan that has become a cornerstone of employee benefits in the United States. Introduced in 1978 as part of the Revenue Act, it is named after the section of the Internal Revenue Code that created it. The 401(k) plan allows employees to contribute a portion of their paycheck to a retirement account on a pre-tax basis, reducing their taxable income for the year. The funds in the account can then be invested in a variety of assets, such as stocks, bonds, and mutual funds, with the goal of growing the account balance over time to provide a source of income in retirement.

Key Features of 401(k) Plans

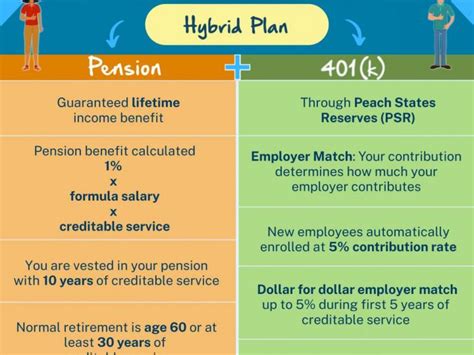

One of the key features of 401(k) plans is the potential for employer matching contributions. Many employers offer to match a portion of the employee’s contributions, which can significantly increase the overall amount of money saved for retirement. For example, an employer might match 50% of the first 6% of the employee’s contributions. This means that if an employee contributes 6% of their salary to the 401(k) plan, the employer will contribute an additional 3%, resulting in a total contribution of 9% of the employee’s salary.

Types of 401(k) Plans

There are several types of 401(k) plans, including traditional 401(k) plans, Roth 401(k) plans, and safe harbor 401(k) plans. Traditional 401(k) plans allow employees to contribute pre-tax dollars, which reduces their taxable income for the year. The funds in the account grow tax-deferred, meaning that the employee won’t have to pay taxes on the investment earnings until they withdraw the money in retirement. Roth 401(k) plans, on the other hand, allow employees to contribute after-tax dollars, which means that they have already paid income tax on the money. The funds in the account grow tax-free, and the employee won’t have to pay taxes on the withdrawals in retirement.

| Type of Plan | Contribution Type | Tax Treatment |

|---|---|---|

| Traditional 401(k) | Pre-tax | Tax-deferred growth, taxable withdrawals |

| Roth 401(k) | After-tax | Tax-free growth, tax-free withdrawals |

| Safe Harbor 401(k) | Pre-tax or after-tax | Tax-deferred growth, taxable withdrawals (or tax-free for Roth contributions) |

Benefits of 401(k) Plans

401(k) plans offer a number of benefits to employees, including the potential for tax-deferred growth, employer matching contributions, and the ability to save for retirement on a pre-tax basis. Additionally, 401(k) plans are portable, meaning that employees can take their account balance with them if they change jobs. This can be particularly beneficial for employees who change jobs frequently or who work for smaller companies that may not offer a pension plan.

Investment Options

401(k) plans typically offer a range of investment options, including stocks, bonds, mutual funds, and target date funds. Employees can choose from a variety of investments to create a diversified portfolio that aligns with their individual risk tolerance and investment goals. It’s generally recommended that employees diversify their portfolio by investing in a mix of stocks, bonds, and other assets to minimize risk and maximize returns.

- Stocks: offer the potential for long-term growth, but come with higher risks

- Bonds: offer relatively lower risks and fixed income, but may have lower returns

- Mutual funds: offer a diversified portfolio of stocks, bonds, or other assets, and can be actively or passively managed

- Target date funds: offer a diversified portfolio that automatically adjusts to a more conservative asset allocation as the employee approaches retirement

What is the maximum amount that can be contributed to a 401(k) plan in a given year?

+The maximum amount that can be contributed to a 401(k) plan in a given year is $19,500 in 2022, or $26,000 if the employee is 50 or older and is eligible for catch-up contributions.

Can employees borrow money from their 401(k) plan?

+Yes, employees may be able to borrow money from their 401(k) plan, but this should be done with caution. Borrowing from a 401(k) plan can reduce the account balance and may result in penalties and taxes if the loan is not repaid according to the plan's rules.

In conclusion, 401(k) plans are a valuable employee benefit that can help individuals save for retirement and achieve their long-term financial goals. By understanding the key features, benefits, and investment options available in 401(k) plans, employees can make informed decisions about their retirement savings and create a more secure financial future.