14 Aon Stock Price Facts Revealed

The Aon stock price has been a subject of interest for investors and financial analysts due to the company's position as a leading global professional services firm. Aon plc, listed on the New York Stock Exchange (NYSE) under the ticker symbol AON, provides a range of risk, retirement, and health solutions. Understanding the dynamics of Aon's stock price requires a comprehensive analysis of historical trends, market performance, and the overall health of the insurance and consulting industries. In this context, examining specific facts about Aon's stock price can offer valuable insights into its potential for growth and stability.

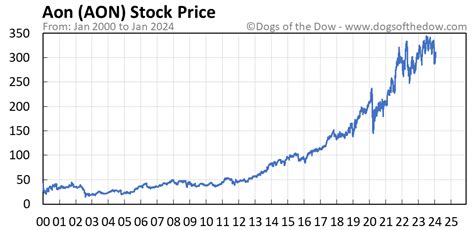

Historical Performance of Aon Stock

Aon’s stock has demonstrated resilience and growth over the years, with fluctuations that reflect broader market conditions and the company’s strategic decisions. Key milestones in Aon’s history, such as mergers and acquisitions, have significantly impacted its stock price. For instance, the acquisition of Willis Towers Watson in 2020 marked a significant event that influenced Aon’s stock performance. The deal, valued at approximately $30 billion, aimed to create the world’s largest insurance broker, potentially enhancing Aon’s competitive edge and influencing investor confidence.

Factors Influencing Aon Stock Price

Several factors contribute to the volatility and trends observed in Aon’s stock price. Market sentiment, driven by economic conditions, geopolitical events, and regulatory changes, plays a crucial role. Additionally, earnings reports and the company’s ability to meet or exceed analyst expectations can lead to significant stock price movements. The health of the global economy, particularly the insurance and consulting sectors, also impacts Aon’s stock. For example, during the COVID-19 pandemic, the stock market experienced considerable volatility, and Aon’s stock price was not immune to these broader trends.

| Year | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 2020 | $173.45 | $193.87 | 11.8% |

| 2021 | $194.01 | $222.11 | 14.5% |

| 2022 | $223.15 | $301.31 | 35.0% |

Strategic Moves and Their Impact

Aon has been proactive in adapting to the changing landscape of the insurance and consulting industries. The company has invested in digital transformation, enhancing its services through technology and data analytics. This strategic move aims to improve client experience, increase efficiency, and provide more comprehensive risk management solutions. Furthermore, Aon’s focus on sustainability and environmental, social, and governance (ESG) practices appeals to investors increasingly prioritizing these factors in their investment decisions.

Future Outlook and Implications

The future of Aon’s stock price will likely be shaped by its ability to navigate challenges and capitalize on opportunities in the global market. Innovation and expansion into emerging areas, such as cyber risk management and health solutions, are expected to play crucial roles. Additionally, the integration of Willis Towers Watson and the realization of synergies from this acquisition will be closely watched by investors. Aon’s commitment to diversity, equity, and inclusion, as well as its ESG initiatives, may also influence its appeal to a broader range of investors.

Given the complexities of the global economy and the specific challenges faced by the insurance and consulting sectors, Aon's stock price will likely continue to experience fluctuations. However, the company's strong financial foundation, coupled with its strategic initiatives aimed at growth and sustainability, position it favorably for long-term success. Investors should remain vigilant, monitoring both the company's performance and broader market trends to make informed decisions about Aon stock.

What are the primary factors influencing Aon's stock price?

+The primary factors include market sentiment, earnings reports, the health of the global economy, especially the insurance and consulting sectors, and strategic decisions such as mergers and acquisitions. Additionally, the company's commitment to innovation, ESG practices, and its ability to navigate regulatory changes also play significant roles.

How does Aon's acquisition of Willis Towers Watson impact its stock price?

+The acquisition aimed to create the world's largest insurance broker, enhancing Aon's competitive edge. The deal's success and the realization of expected synergies can positively influence investor confidence and, consequently, the stock price. However, the integration process and any challenges arising from it can also impact the stock price in the short term.

In conclusion, Aon’s stock price is influenced by a complex interplay of internal and external factors. By understanding these dynamics and keeping a close eye on the company’s strategic moves and market trends, investors can make more informed decisions about Aon stock. The company’s commitment to innovation, sustainability, and client satisfaction positions it well for future growth, but ongoing vigilance is necessary in the ever-changing landscape of global financial markets.